Last week, I wrote the Mileage Earning 101 – India Edition 2013, where I had provided you my views on all the credit cards you could use to earn miles in India. I got quite some feedback and requests, including one for a calculator. That prodded me to pull out an old worksheet from 2011 and add some columns to it, adding all the new information available to it. I hereby present to you Version 1.0 of the worksheet, which you can directly access from Google Drive here.

Here is how to use it with just a few simple inputs:

Step 1: Input if you are a JetPrivilege Platinum Member or not.

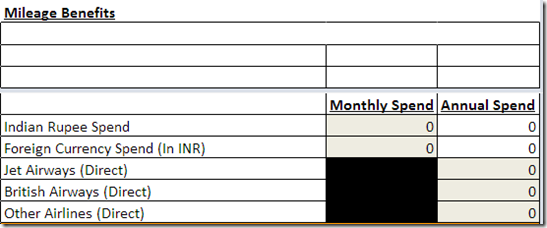

Step 2: Input your monthly domestic spend and foreign currency spend (the worksheet will 12x it), and if you spend any money on booking tickets directly on jetairways.com, British Airways or other airlines.Take note, the keyword is direct, that means without using a travel agent.

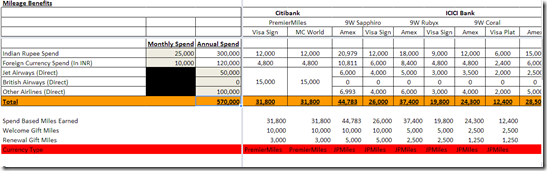

Output: With a sample input shown below, you will see the output projected for all the variants of the credit cards considered. Here is a sample snapshot:

You also see the mileage currency you earn in the same column, because all miles are not the same. PremierMiles, JPMiles, British Airways’ Avios, Miles & More, etc.

You also get to see the lounge access benefits, the cost per mile for you (factoring in your Jet Airways status, which gets you free cards from Jet Airways), and the other important information such as renewal bonuses. Do note, this is not an exhaustive list, and is subject to change of information from the banks.

Do let me know what do you think, and how can I make this better.

Happy earning & burning!

Live From A Lounge is present on Facebook, Twitter & available via email, RSS.

Hi Ajay

The formula in cell C10 (annual domestic spend) should be B10 (monthly domestic spend)* 12. It is currently B11 (international domestic spend)* 12

Ajay I tried finding an email id to mail you but could not find one in your site.

It is there in the About Me section. you could send me an email at aj at livefromalounge dot com

I have been religiously using my Citibank premier miles card for all my domestic spends which amounts to around 130000 a month. on using the calculator I found that I earned 62400 premier miles in a year against 124800 under the visa 9W sapphiro. I cannot understand how the miles are double. I visited the icicibank website and found that the JP miles earned is 4 for every 100 spent. Besides they have capped the JP miles you can earn in a year to 60000.

@aaron While PremierMiles sounds right, I will have to check the visa issue. Can you send me screenshot on email please. thanks

I seem to be getting the best value out of ICICI BA MC. Nobody seems to be discussing it? What do you guys think of it? Is it value for money?

Hi, can you include the SBI Air India card in this please. Thanks

Thanks! This is quite helpful. However, I just wanted to check that this has been updated recently.

From my comparison, I used a spend of 25000 a month and 10,000 a year on Jet direct. It seems the Jet Sapphiro Visa ICICI is best. The runner up is Amex Jet and offers unlimited lounge access and Amex assist but for an additional 5k in annual fees.

Thanks again!

@Nikhil, the SBI Air India credit card is missing here. But I plan to do a big update once the ICICI credit card special offers wear off, so I am holding back till then.

Thanks, AJ. I’d had a look at that and it wasn’t clear at all. I guess better stay away.

Hi AJ, just wondering if you are familiar with the IndusInd World Miles card? They seem to offer miles that can be redeemed on any airline. Not sure how it compares with other cards though.

IndusInd has offered me a Signature credit card to replace the miles and more card. In the mail they claim you can collect airline miles, but on their website I couldn’t get any information on how.

I think this is going the Citibank-Jet breakup way. IndusInd will try to entice existing cardholders, but who knows how long these will last.

@Anil, have a look at the mileage earning here, it is so complicated on that card: http://www.indusind.com/indusind/web/wcms/en/home/personal-banking/creditcards/premiumcc/worldmilescc.html

The Axis card is for free? According to the mail I received even the Axis world card has a joining fee of Rs 3500 (waived for existing m&m members against zero miles joining bonus) and annual fee of Rs 3500+ST.

Will have to shuffle my cards a bit – have a Stanchart Titanium, which doesn’t earn me any miles but gets me cash back on my utility and petrol bills. Was initially thinking of switching this to the Emirates card, but from what I can gather it’s not that great and the annual fee may not justify it for my purposes.

Plus I have a regular ICICI card, which I can switch to Jet.

@anil my bad i thought it was free. Did not see the T&C carefully. You may be right for axis.

All I can add is the best combination is premiermiles plus the jet card which suits your pocket best.

Thanks again for the quick response AJ and for clarifying. Just to make sure I’ve understood correctly: by mileage currency you mean the miles I would earn/accrue against my spends, right? I’m not inputing any miles btw, just my spends.

Premier miles sounds/sounded like a good way to go, although I was just reading your post on the recent devaluation. Or avios, except oneworld isn’t that great for India connections, although that might change with Quatar Airways joining soon.

Am basically reviewing my credit card options.

I was on the IndusInd Miles&More card, am wondering whether to accept the switch to Axis or move to another card entirely.

@Anil I think anything is better than the miles and more cards. Take that for free though from axis. Then, take premiermiles and one jet card and you are sorted!

Hi AJ, thanks for the calculator. Was just trying it out. What I haven’t figured is what you mean by “You also see the currency you earn in the same column, because all miles are not the same.”

What do you mean by currency?

What I initially figured was that the more mile equivalent currency you get, the less your cost per mile should be. But that doesn’t seem to work out, e.g. on the ICICI 9W Coral Visa card, the currency is 6400 – basically I’d expect to be paying more per mile seeing this figure – but the cost per mile is only 0.16/0.18, which is practically the same as some of the other higher currency earning cards.

So could you explain? And also what it means that all miles are not the same?

Thanks!

AM

@Anil, thank you for your feedback. I changed Currency to Mileage Currency. As for your second thought, you don’t need to input the miles earned. you need to just enter your spends and the output will grow as per your spends. So, cost per mile comes down as you increase your spend.

As for not all miles being the same, it means some miles are more flexible for use, for instance PremierMiles can be transferred to various airlines and redeemed on them. On the other hand Jet Miles can be used on Jet airways flights and in the rare case they let you use them on their 20 odd partners. British Airways avios on all Oneworld airlines. So, you can’t use Lufthansa Miles on British Airways and vice versa. I hope I am clear?

Like always thanks AJ for such great help.

Hi Aj,

Many thanks for this. Very useful tool and I am planning to put it to use immediately!

Cheers

@AJ – Got it. Thanks again for this. I too have made some compilations. Will send it across for your reference

Will suggest giving some credit to deepakvalecha from flyertalk given he also created and shared something like this yesterday unless you had it ready earlier 🙂

@parag like I mentioned, this is from 2011 and reworked for a while now. I know he did some good work too. Me i was waiting for all the banks to come out with their information

Fantastic work as usual AJ, Thanks a lot