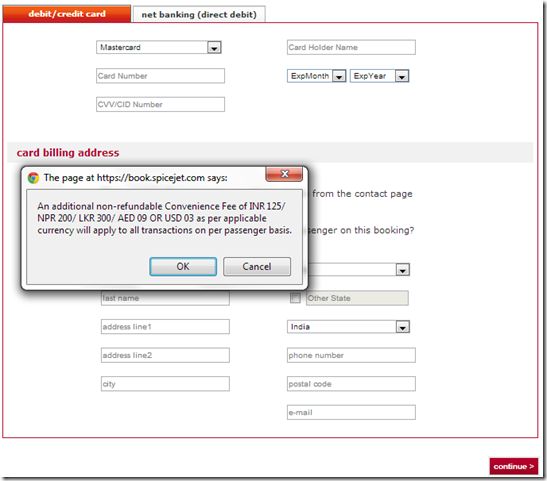

Beginning of this week, the regulator of Indian aviation DGCA and the Federation of Indian Airlines (FIA) were slammed with a lawsuit in the Supreme Court of India, asking them to explain all the charges that are imposed on top of the base fare of the ticket, such as the transaction fee which pops up just when you are ready to enter the payment details on the credit card page, something like this:

The industry and its regulator were asked to explain the extra charges, and whether these had the backing/approval of the government. For instance, even the Mumbai and Delhi airport were asked to explain the extra User Development Fee charged. Here is an excerpt from the full newsreport:

But Justices DK Jain and Madan Lokur, hearing a petition that raised objections to the User Development Fee (UDF) being charged by different airlines, went beyond the scope of the petition to ask regulator DGCA, the FIA and the Delhi and Mumbai airport operators DIAL and MIAL to explain the rationale of imposing extra charges on passengers such as UDF, Airport Development Fee and transaction fee.

…

The DGCA was asked to explain whether it had taken any action against any airline for violating their tariff bands. The court also asked the regulator to state in an affidavit all circulars and orders issued to airlines on tariff fixation and collection of other charges from passengers.

These charges first came into existence in June 2012, to the best of what I know and Jet Airways started the practice.

It seems the first judgement have already been made by the court within 2 days, and airlines have been asked to resist from charging any sort of transaction fee on the customers, under whatever name. While I don’t think this will lead to refunds, you can expect to see at least 150 Rs. per passenger charges coming down in the days ahead on the domestic legs, since fees such as this will go away.

(H.T.: Pradeep Nalluri)

Related Stories:

- Another new Jet Airways convenience fee now in place!

- Is phone booking the new way to avoid credit card convenience fee on Spicejet?

Live From A Lounge is present on Facebook, Twitter & available via email, RSS.

This practice is done by Trident, Oberoi, Taj, Sheraton, ITC, Radisson, ALL hotel chains in India that are qualified to charge luxury taxes.

Hopefully Indian hotels will soon be asked to justify their practice of adding room taxes calculated on the published “full fee” rack rate of a room, rather than the price that you are actually paying.

I hate the practice of hotels saying they have given you a “free room upgrade” and then charge much higher room taxes for the highly inflated rack rate of the “upgraded room” or suite they have put you into irrespective of the actual room cost you have paid.

Surely tax can only be calculated on actual money paid – not money the hotel would like to charge you if it could?

@Brett, can you tell me which hotel have you had this experience with? In my experience in India and around the world, the taxes are always paid on the amount paid, not on another number. Please share your experience.

Hi AJ

I travel to India frequently, and this has been the STANDARD PRACTICE for all “luxury” class hotels in India for a long time.

Every room has a published rack rate that is usually much higher than the price the guest actually pays. The tax on “free upgrade” is almost always calculated on the rack rate of the upgraded room. If my room costs 5,000Rp, and tax is 23%, then I will pay tax of 1,150Rp – a total room cost of 6,150Rp. However if my room costs 5,000Rp but I am given a “free upgrade” to a suite with rack rate of 15,000Rp, then I will still be charged 5,000Rp for the room, but the additional tax will be calculated on what “I could have been charged if the hotel charged me full rate), i.e. 3,450Rp – a total bill of 8,450Rp!

I have challenged this process MANY MANY times, and have just been told that this is how it is done.

I refuse to believe that this is correct, and feel that tax should only EVER be calculated on the actual rate that is being charged (and money being paid – 5,000Rp), not what the hotel could have chosen to charge me.

Good job. Those ####### were trying to get away.