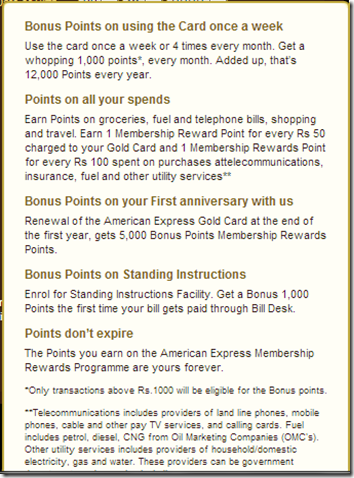

It seems there is quite some amount of rework happening with the American Express Gold Charge Card offered in India. The card was being offered for free for the first year, and a fee of Rs. 4,500 (plus taxes) from the second year onwards. One of the key benefits of the card was the ability to earn a 1000 Membership Rewards points bonus by just making 4 transactions for Rs. 250 each per month.

However, quite some things seem to have changed now. First, the card does not come free for the first year, but for a fee of Rs. 2,500 (plus taxes).

And secondly, the feature to get 1000 bonus points after 4 uses of the card in a month seems to have has been changed as well. Now, only purchases beyond Rs 1000 will count towards this bonus (up from Rs. 250).

While there has been no communication to the effect of the second change, I am sure if this is true the card loses its relevance in today’s scenario where you could potentially earn a lot more in terms of points or miles by using another credit card or mode of payment.

Anybody got any more insight on this? Or any official communications from Amex?

Update: Few cardholders have received official communication in this regard from Amex today, and changes will be effective from October 1, 2013

(Hat Tip to RH)

Related Posts:

- Sunday Plastic: The American Express Gold Charge Card

- American Express devalues Membership Rewards in India

Live From A Lounge is present on Facebook, Twitter & available via email, RSS.

But in most of the outlets, AMEX is still not the preffered credit card.

In Mumbai, there are too many places where AMEX is being rejected.

following are few of them

Monginis cake shop

The Village, Kandivali

BP petrol pump, Kandivali

Masterchef, Dahisar

Have you looked at the axis bank mills and more card? It offers free travel insuranc cover up to $250k if you buy your tickets in the card. Worth it no?

I too received the email today about the downgrade. I recently renewed the card and Amex waived the renewal fee. So long as I get to keep the card for free, I feel it is still worth it, 1000 MR for Rs. 4000 is still a good reward earning rate. Of course there is no point using this card for charges beyond Rs. 4000/- every month.

Received this e-mail as well. This will be effective as of 1 October 2013. The 18 carat and 24 carat Gold Collection has been expanded to include two newly added American Express Gift Cards worth Rs.7,500 and Rs.10,000.

Just completed a year with them (card was free for 1st year) and got a waiver of 50% on second year fee from them. But I believe given this revision, I am certainly not renewing it in the 3rd year unless they give some new features to make it competitive.

What a shame! though AMEX could have pumped up some other features/advantages to stay in the game.

I have recd an official communication from Amex.. the threshold limit has been increased to Rs.1000/- per spend up from Rs.250/- whilst the no. of spends is still 4. There is no mention of the charges…any increase or decrease…

This communication came in about 30 mins back

Got a mail from Amex notifying of the change from Rs 250 to Rs 1000, so it’s official now.

I got this Email just a while ago. Text below..

———————–

We hope that your American Express Gold Card has been complimenting you with its various benefits and privileges. It is our constant endeavour to serve you better with our products and services.

This communication is in reference to the 1,000 bonus Membership Rewards® Points earned by spending on your American Express Gold Card with minimum 4 transactions of at least Rs.250 each in a calendar month. In this connection, we wish to notify that with effect from October 1, 2013, this threshold of Rs.250 is being increased to Rs.1,000. However, the requirement of minimum 4 transactions in the calendar month remains same. All other terms and conditions related with the product remain unchanged.

Additionally, we are pleased to unveil the upgraded Membership Rewards Gold Collection. The 18 carat and 24 carat Gold Collection of sparkling rewards has now expanded to include two newly added American Express Gift Cards worth Rs.7,500 and Rs.10,000. The American Express Gift Cards are Prepaid Cards equivalent in value to the Indian Rupee and are widely accepted by thousands of merchants and online websites that accept American Express Cards across dining, travel, health and retail.

Redeem from a wider range of rewards with the enhanced Gold Collection. Avail your Membership Rewards Points for the newly added American Express Gift Card.

18 Carat Collection – 18,000 Points

• American Express Gift Card worth Rs.7,500 • Citizen Eco-Drive Watch^

• Croma Voucher worth Rs.7,500 • Tanishq Voucher worth Rs.7,500

• WelcomHeritage 2 nights/3 days luxury stay

24 Carat Collection – 24,000 Points

• American Express Gift Card worth Rs.10,000 • Bose Docking Station^

• Apple iPod 8GB • TISSOT Watch^

• MakeMyTrip Holiday Voucher worth Rs.12,000

—————————-

If this indeed comes out to be true, the biggest USP of this card will be down in dumps. I would probably give-up the card in november after completing 1 year, and transfer all my MR points to a FFP.

Hoping against hope this turns out to be a typo.

AJ, I spotted both the changes and also checked with AMEX. The CC was totally clueless of the change and insisted that the previous min transaction limit Rs 250 still stands good. I had though of applying to this, however, I do not want to be taken for a ride if the terms for bonus points change overnight. In case you are able to gather anything, can you please pass it on?