One of my posts about the conversion from Citibank PremierMiles to Citibank Prestige quite set the cat amongst the pigeons out there. While everyone does want to double their miles with the arbitrage, I was inundated with email over the weekend about the differences and the similarities.

I just thought I’d put my perspective out here:

Citibank PremierMiles in my opinion, is the card targeted towards the travellers. You earn PremierMiles towards various purchases, and earn very high number of PremierMiles for airline purchases. You also get higher number of PremierMiles if you buy from certain brands or websites. Alongside, there are acceleration offers where Citi offers additional miles for certain category spends from time to time. You can then use these miles accumulated to:

- redeem for tickets at a cash value of 0.50 INR per mile.

- transfer miles to airline and hotel programs and redeem for award tickets or hotel stays.

One of the things I find a lot of holders of this card doing is pegging the value of a PremierMile at INR 0.50. In my book, PremierMiles are much more than that and you need to make use of the transfer partners to be able to get that value. For instance, 9000 PremierMiles transferred to Air India on a 1:1 basis which get you access to a Executive Class ticket on a sold out Goa – Mumbai ticket on a long weekend, or 77000 PremierMiles transferred to KrisFlyer on a 1:1 basis to get a Los Angeles- Singapore – Mumbai all business class ticket, which would retail for $4000 gives me much more value than 0.50 INR in each case. While I don’t put a hard floor on my value of the PM, at least 1 INR is the minimum I’d like to have when redeeming my PM.

The Citi Prestige is a lifestyle card, and to start with, you need to have an income of at least INR 40 Lakhs to be able to qualify for it. This card, is not just about earning miles. But lets dwell on the mileage earning first. You get 1 Prestige point (= 4 airmiles) per INR 100 spent. You get 2 Prestige Points (= 8 airmiles) per INR 100 spent abroad. None of these miles can be directly redeemed at INR 0.50 value. Everything is transferable to the pretty much the same partners as PremierMiles in terms of hotels and airlines.

Alongside, you get so many benefits which are worth a lot:

- Up to 5 Priority Passes valid for unlimited use (card holder + all add-on holders get it)

- Etihad Gold status + 5000 Etihad Miles (which you can use on Jet Airways amongst other airlines)

- 10000 airmiles every year transferred as 2500 Prestige points into your account

- INR 10000 worth of Taj Hotels or ITC Hotels redemption vouchers every year

- Taj Epicure Plus, which gives you Taj Gold status and a bunch of dining vouchers (Pro Tip: I just dined with friends past weekend at a Taj in Mumbai, the buffet price was cut to 1/2 using the vouchers, and yes, 20% off the spa)

- Golf benefits for those who like to play golf

- Overseas medical insurance worth USD 50,000

- If you fly BA, you also get status and 5000 Avios on BA on completion of one trip with BA.

- Hilton, Shangri La status.

- Access to invitation only events such as the dinner with Nicolai Freidrich

- Concierge service, something that I tend to use a lot at times

In short, there is a lot more at work here rather than just accumulating miles with the Prestige card. I took it because I’d like my family to travel in comfort, and hence I’d like them all to have lounge access at airports. Additionally, I see break even with the 10000 miles and 10000 INR worth of vouchers itself. With the Priority Pass, I get access to lounges everywhere I travel, and with the insurance policy, I don’t have to bother everytime I am on my way somewhere to get a new policy issued.

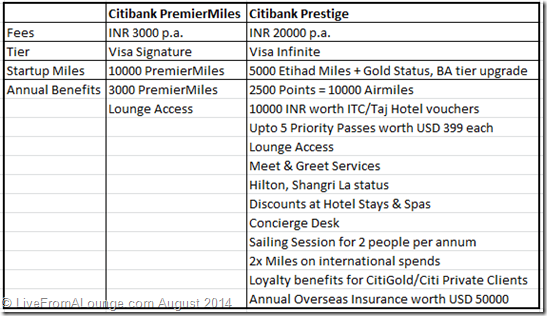

Here is a short table summarising the benefits of both of these:

In my book, both the cards don’t compare but complement each other. While the PremierMiles is a must have for an infrequent traveller, the Prestige is a must have for the frequent traveller, or if you are outside India a lot.

I am sure there are benefits I’ve held back to make the comparison even. As for having both the cards like I do, I think that is a special circumstance and I should comment on it as well. At the time that Citibank discontinued their association with Jet Airways, all Jet co-branded card members were offered the Citi PremierMiles Card at a reduced fee as a replacement. Now, those who had the MasterCard version of PremierMiles already, were the ones who got the Visa Signature version as replacements to their Jet co-branded cards. If you want to move your PremierMiles to the Prestige and still get a PremierMiles as well, you’ll have to do the process one by one and not both together. Which means:

- Step 1: Convert PremierMiles to Prestige

- Step 2: Apply for new PremierMiles a few weeks after you receive Prestige

Again, it may or may not work and you got to do this at your own risk. Your Mileage May Vary.

I hope I’ve answered your questions about PremierMiles v/s Prestige adequately here. If not, feel free to drop in a comment and I am happy to elaborate further.

Related Posts:

- The Citibank Prestige Officially Launched!

- Credit Card Review: Citibank Prestige India (2014)

- Poll: How do you use your India-minted miles?

- Sunday Plastic: The ‘new’ Citibank Premier Miles Credit Card

Join over 3600 people who check-in daily to find out about the best in travel.

Free emails (once-a-day) | RSS Feeds | Facebook Updates | Twitter | Instagram

Hey Ajay,

Citibank is currently revamping its rewards program with Premiermiles card; main change being that airmiles will be transferred at rate of 2:1 rather than 1:1 from 1 feb 2015 onwards. Haven’t heard of similar change on Prestige card, does that make prestige more preferable for travelers, since the main selling point for Premiermiles is being diluted by 50%?

AJ,

Are you saying that with vouchers and / or Taj Epicure membership you get 50% off on Buffet price at Taj properties?

@Krishnakumar only one of the voucher of Epicure Plus gives you a discount one time for 50% off.

I just spoke to citibank and they said that lounge access is not available on add on cards. my travel is mostly domestic so which one (Visa/MC)would be a better option for me? any other difference between the two options?

Thanks

@Nilesh you should check premiermiles.co.in and see which cities you frequent and choose the MC/Visa version accordingly.

Hi Ajay! (i) Is it possible to transfer Etihad miles to Jetprivilege for JP miles or is the only way to use the Etihad miles to book a flight? (ii) If one gets Etihad gold status through the citibank prestige card, is there any arrangement b/w Etihad and Jet, which makes it possible to get an equivalent status on Jetprivilege (gold) on that basis? Thanks!

@Tanmay no Etihad miles cannot be transfered to JP, but you can book a jet flight by calling etihad as well. only, they don’t do last minute flights, 14 days our or so only. Etihad gold does not get you jet gold, but gets you treated as a jet gold. check here: http://livefromalounge.boardingarea.com/2014/05/22/jet-airways-and-etihad-airways-announce-reciprocal-benefits/

I have both the cards already. After reading your blog asked citibank if they could transfer my premiermiles miles to prestige points and they refused. Is there any way to do this now that I would like to keep both the cards?

@vikasr this conversion is not between Premiermiles and Prestige points. it is only possible when you convert your premiermiles cc to prestige cc. I hope that clarifies.

Does PM provide PP in any form? thinking of getting one for myself

@nilesh no. They used to provide it in 2011 but discontinued it in 2012.

Hi Ajay,

Do you have any idea as regards which of these features are likely to continue for future renewals. Although it looks exciting for the 1st year, the Citibank website says that many of the features are valid only upto 31 December, 2014. Wondering whether this makes this card a long term value proposition. Thanks in advance.

@Amit, no premium credit card offers features on a full time basis, just to manage expectations. For instance, even with Amex, all features come with an expiry date. And then, they get renewed. Here, for instance with Citi Prestige, I expect Priority Passes to continue, not sure about BA and Etihad for the time being.

I was just asking Citi Singapore the same question the other week.

Is Etihad Gold also for Singapore cards ?