All good things must come to an end

– Geoffrey Chaucer

This adage, said to be coined in the 1300s is coming true with most aspects related to Air India’s loyalty program. Three years ago, Air India and SBI partnered up to launch a dream card, which gave not just a lot of miles, but a lot of miles on achieving spend milestones, and even airline status with Air India on completing spend. Top it up with generous status matches which allow you to get a headstart with Air India. The purpose of this card was to seed the market with Air India miles, something that the market was not used to given Jet Privilege was the proven partner of choice for most establishments.

And now that Air India Flying Returns is basically restructuring, not just to eliminate fakes, but going back to their line of thinking that they don’t really need to reward anyone for their loyalty, they are taking this card in their sweep too. I am told the features of this card are jointly arrived at by some sort of a council that has members from AI and SBI Cards.

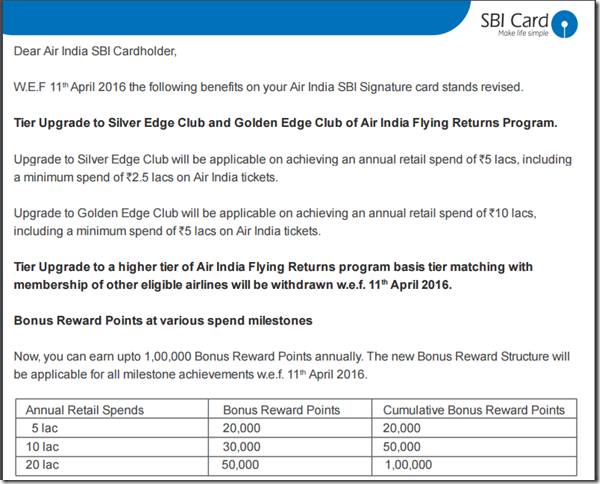

So, while I was away for a weekend, SBI Cards quietly pushed out an email to all their members, announcing a massive devaluation as of April 11, 2016. The changes only affect the Signature version of the cards, and not the lower version. Here is the communication:

Milestone Spending tiers doubled, but points only go up 10%

In the earlier set-up with the Air India SBI Signature Card, you had an opportunity to earn 90K extra AI miles with a spend of INR 10L, now, you can only earn 100L extra AI miles with a spend of INR 20L. This is a double whammy, especially when you look at it in totality, where almost all Air India sectors have moved up in requirements for flights, and Star Alliance flights too, oh, and Upgrades as well. So, overall, the miles you earn are worth much less as compared to how much they were worth three years ago.

Earlier, you needed to spend INR 7.69 to earn a mile, if you were spending a total of INR 10 Lakhs on this card, now, this moves up to spending INR 11 to earn one mile on a spend of INR 10 Lakhs, as well as on a spend of INR 20 Lakhs. That means, a 44% more spend required per mile to be earned.

Not just that, a lot of our readers here don’t spend that kind of money on this card, so for those who spend lesser as much as INR 5 Lakh to earn the first bonus, you are spending INR 12.5 to earn a mile. That moves your goalpost by 66% to earn a mile.

This move itself kills this card for me. But, there is more…

Tier Upgrades on spend now require compulsory Air India spend/ Status matches going away.

One of the key reasons I came back to Air India after a long time, was the ability to go straight up to Gold Tier. For the first year, I did it by tier-matching, which is still available till April 11, 2016 and then going away. Then, I maintained it by spending on the card. There is no other way for me. Air India awards miles in a miserly manner on flights as compared to Jet Airways, except for a brief 6 months or so in 2015, linking it to revenue earned on a ticket. On the other hand, they have still not figured out how to make elite status by just taking segments. They want you only earn the status by doing a minimum number of revenue flights.

The same wave is now coming to this credit card as well. Earlier, a spend of INR 5 Lakh within a year used to get you Silver tier on AI, while INR 10 Lakh spend got you gold tier. Now, you need to ensure you spend INR 2.5 Lakh of your INR 5 Lakh spend to Air India directly to get Silver tier. And INR 5 Lakh out of INR 10 lakh on AI spend for the gold tier.

While the silver tier was never any use for me, since it gets you nothing, I always would like to have gold status with AI, but I can’t guarantee I’d spend INR 5 Lakh on Air India tickets to get the status.

Bottomline

This card used to have a prized place in my wallet, and I am now just figuring out it won’t have that space anymore. I’ve not spent on this card in my current year, since I was afraid such a thing could happen, given all the large scale changes at Air India Flying Returns over the months. I’m going to junk it sooner than later then, and move the spending to another card.

What hurts the most is that they created a product, got the users in, and now devalued, with no attempt to make good to old loyalists.

Readers, do you still see a silver lining with this card? My use case for this one looks gone at best!

Join over 5000 people who check-in daily to find out about the best in travel.

Free emails (once-a-day) | RSS Feeds | Facebook Updates | Twitter | Instagram

I assume most of us will end up downgrading this card to some other SBI card. So, which one is it going to be?

You can’t downgrade the card. To get another SBI Card, you’ll have to cancel this and start fresh. But they have given us an account number along with the credit card. That might be of some help.

What? Which card company doesn’t allow you to change cards? Stupid people.

I already have an account with SBI, but I’m quite surprised that we can’t change cards.

It’s an Indian Bank, what else can you expect!

Has this changed recently? And miles earning is back to old rates? Current offering says cumulative spend of ₹3L -20k reward points and ₹10L-90k reward points.

Please suggest if this is worth applying.

@Ajay,

For those who have crossed the 3L spend, should they go on to spend 5L and then cancel their card or do you recommend cancelling the card now?

The reason to ask is that though we are not getting the Tier upgrade, we can get the bonus points! And spending another 2L is not that difficult for those who have crossed 3L already!!!

Please suggest!!

@Shubham it is a personal decision for everyone. I don’t see 20K air india miles as a gamechanger to put 2L on that, while someone else may have a different situation in their case

Had got the AI gold last year thru spends. Status expiring in April. Card renewal due in October. Just crossed the 5L threshold last month. So no point in going for 10L mark now.

Hi, I guess SBI AI card is going to loose the primary usage status out of my pocket. May be time to switch back to HDFC Jet (Already switched from Citi PM once they devalued that).

I have 1L+ points with my SBI card. Any suggestions on the optimum usage of these points? I have a travel coming for Dubai around Holi, should I redeem these points for that travel?

Thanks Guys.

I have my renewal coming up this month and now the clear answer is no. I am going to move all my miles of AI whatever they will be worth and say bye to this one. Ajay looking forward to your post on which card makes good sense now. Does HDFC allow both regalia and diners to the same cars holder?

Yup. The moment that mail hit my mailbox I decided to remember my PIN for Citi PM and ICICI signature cards :). This piece of crap now along with AI Loyalty miles redemption mess means good bye to both the card and AI.

I was pushing SBI to upgrade me to the Signature from my existing Plat, happy that it didn’t work out, however in the interim AI did elevate my level to Silver matching JP status. I do an annual spend of about 8L split between Regalia 30% & SBI 70%. I know I’ll never get a status upgrade on my spends with SBI, but I am simply looking at miles accrual and utilization with abundant lounge benefits on Regalia (15 on PP). Just checking if the bonus miles on spends is on every slab of 5L or once per year?

I’d love to pick your brain on the best earning card right now for general everyday expenses.

Would like to see you rate Citi PM and HDFC Diners Cards for such spend.

Amex Gold is okay, but excludes utility payments which is a negative for me.

Citi PM devaluations sucked when they happened, but those miles aren’t looking half bad now.

(I’ll exclude Citi Prestige because it is out of bounds for 90% readers)

@Deo: Diners (Rewardz) wins over Citi PM for sheer value in terms of points, so long as you dont want to transfer to too many exotic partners. Assuming you arent getting a Diners Black.

@ J G: Would you still say that after 31st March when the 10x rewards scheme has been pulled?

The reality is setting in. Indian credit cards were way too generous compared to US ones and this had to end at some point of time. Amex, citi, hdfc, and now sbi have all devalued their points or made earnings harder. It was too good to be true anyway. My yearly membership expires in November and I’ll not be renewing this card for sure.

@Shan, I disagree, most Indian cards do not offer even a patch on US credit cards. They get sign up bonuses like 30-50-100K, do you ever see that in India?

@Shan

I agree with Ajay.

Its only these American banks which are the most liberal in terms of giving points. In the US, the same banks give sign up bonuses without charging you a fee. You just need to have the best possible credit score.

Its quite an disappointment, I used this card to accumulate 2.5L miles in 1.5 years, however now I have made my mind to redeem these points in next one month or so and then close this card for good.

The trouble is I have not been able to make my mind on what should be my next primary card, any suggestions?

@zoorg wait for my credit card strategy post later this month

Thanks Ajay, looking forward to it

@ajay waiting for that post. But just for starters what do you recommend regalia vs premier miles

I would recommend wait for the summers. Air India generally has summers offers where all sectors are available for redemption at 30% lower miles (or something like that). Keep the miles for that promotion. Unless your credit card renewal is due.

My renewal for this Card is in June 2016, I will use these miles by next month.

You won’t believe your luck. Air India just announced 40% off on redemptions (though it has been implemented since 14th March, whatever–air India. Hahah. Lucky you. Book fast else it will it run out. Safe travels.

@yashraj, I’ve known about this but did not put out due to paucity of time. Anyhow, only valid on weekday travel.

No sweat. Keep rocking.

Hi AJ, thanks for this.

I am currently at 2.5lakhs, if I complete 3 lacs before 11 April, will be eligible for the spend bonus then?

Also, if I complete 2 lakhs more before my annual year (Nov 16), will I get 20,000 miles more?

thanks

@Ankit you will get the spend bonus for 3L, but not for the 5L.

I have completed my 3L spend and have received 20k bonus miles. I will be hitting 5L between 11 April and the card renewal date. Based on your reply above I believe their is no point runner after the 5L mark.

Sheer Pity !!! Kudos to SBI / AI, they know best how to lose loyal customers….