Axis Bank and Vistara tied up to launch the Axis Bank Vistara credit card range in July 2016. I applied for the credit card the first day itself, and it has been a few months since I’ve had it in my pocket. I thought it would be a good idea to put out a review of the card for those of you who are planning to pick up an Air Vistara co-branded credit card.

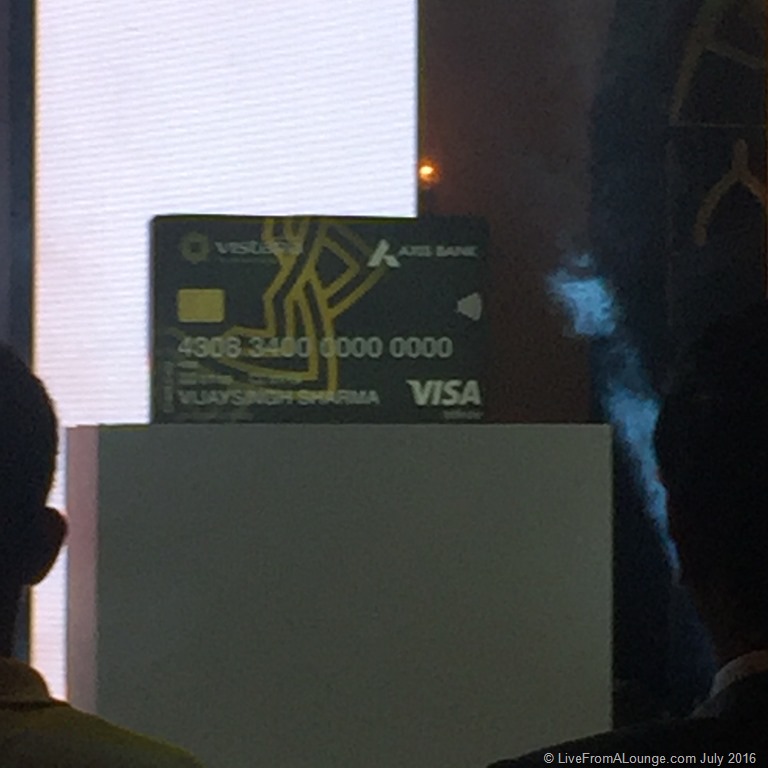

The Axis-Vistara Credit Card comes in three variants, and today we are going to look into the top-end variant called the Infinite. The card is a compelling proposition in case you do spend a lot of time on the road or a lot of time shopping, as it grants you the benefits of Club Vistara Gold. At the time of the launch of the card, Gold was the top-tier in the Club Vistara program, however it is now the second-from-top tier with Platinum taking the top shelf. The Card comes with an EMV chip, which allows you to just waive the card on Visa PayWave enabled terminals. However, not many stores have these in India right now.

Vistara Benefits

The credit card comes with a solid proposition to get you started. You get one business-class ticket coupon code for any sector that Vistara operates on, and all you need to pay is the statutory taxes to redeem the ticket. The ticket is valid for a period of 6 months from the date of issuance.

You also get enrolled into Club Vistara if you are not already enrolled, and you get Gold Tier with Vistara. The Gold Tier usually requires you to take 30 flights in a 12 month period, or earn 25000 CV points. This entitles you to the following benefits:

- 10 Club Vistara Points/INR 100 spent on Vistara flights

- Business-Class check-in

- 10 Kg extra baggage allowance

- 3 upgrade vouchers per annum

- 2 Lounge Access Vouchers

- Lounge Access on all flights

- Priority Boarding & Baggage Handling

Spend Benefits

Currently one of the most lucrative cards in India. You earn 6 Club Vistara Points per INR 200 spent. These points go over to your Vistara account on a daily basis. Additionally, you get the following spend benefits on reaching various milestones:

- 10,000 Club Vistara Points on spending INR 1 Lakh within 90 days of card institution.

- 1 Business Class ticket on achieving INR 2.5 Lakh spend within the membership year.

- 1 Business Class ticket on achieving INR 5 Lakh Spend within the membership year.

- 1 Business Class ticket on achieving INR 7.5 Lakh Spend within the membership year.

Lounge Access

Lounge Access is available when you fly Vistara (since you are a Club Vistara Gold member). For other times, you have access to the Visa Lounge Access benefits (valid only in India). More details of which lounges you can visit are on www.airportlounges.in. You get 4 complimentary visits every quarter to lounges in the list.

Golf Benefits

Axis Bank also offers you 6 complimentary rounds of Golf per annum on this card. The list of Golf Courses is actually pretty nice, but limited to India and requires you to book 14 days in advance.

Eligibility

You need to be earning INR 600,000 per annum to be eligible for this card.

Annual Fees

The fees per annum is INR 10,000 plus applicable taxes.

Foreign Exchange Markup

3.5% plus applicable taxes.

Value Assessment

As Vistara grows its network, the value for the free tickets on offer grows as well. Mumbai – Delhi, which is my usual routing and the only routing of value on Vistara to me right now, has business class priced at INR 30,000 most days. Which means the 4 tickets have a notional value of INR 120,000 for me. Additionally, I’d earn 32,500 points for spending on the card as well (including a 10,000 bonus for 90 days INR 1 Lakh Spend). In total, I’d say I will get roughly 20% value on my spend, or even more. 16% on the basis of the tickets I’m going to redeem and the rest on the basis of the points I would use for an upgrade or redemption sometime.

Overall Assessment

I’d compare the Vistara Axis partnership with the SBI Card at the time of launch. A solid package. The benefits on offer are very good, and if you are a high roller, then this is a good credit card to add to your wallet. The Sales team provided good service, with the sales representative bringing home the credit card for me. I made Shipra apply for this card as well, and she also received her credit card in hand from an Axis Bank representative. However, other aspects can be a hit and miss. For instance, the Axis Bank app does not work on my phone. I do not get any alerts when the bill is generated or the last date of the bill is due. Since I am not an Axis Bank banking customer, not possible to keep a tab on the card for me without a login to the website.

Also, service issues when they happen are bad. For instance, I did not receive my free ticket code in time, so I had to chase up, and eventually I was sent the ticket two months late. However, I was promised service recovery by the Axis Bank representative, but he never called back.

Bottomline

This card is a good diversification from my usual bundle. I’m keeping this in the pocket right now and putting a lot of my domestic spending on this card. It would be great if the card added more points for spending on Vistara itself, since then it makes more sense to have a co-branded partnership and all co-branded cards in India apart from this range offer accelerated earnings on the partner airline.

Have you taken up the Axis Vistara co-branded Infinite Card? What has been your experience with the card?

Do we get a status match to krisflyer gold with this card

Do you get to retain the Gold level on Vistara till you hold this card, I mean from 2nd year after renewal also, or is it only for first year and later (renewal) based on flying activity with Vistara?

My status from Gold Changed to Silver after completing the first year ( & paying second year renewal fee of 10000). I have written to Vistara and Axis bank but haven’t got any reply/clarification as of now. Will update once I get a reply.

The Gold does get renewed after around 3 months, till then you are at Silver. My card got renewed in Aug 2018 and I was back at Gold in Nov 2018.

I have an axis vistara infinite visa card and despite me spending more than the INR 7,50,000 i am not getting the milestone benefits tickets which i am entitled too. I have called the credit card helpline several times and till date no result….

Any clue how does one get these tickets?

Vistara only flies to Delhi from Pune so as such not useful for flying. However my primary interest is in VISA Infnite Book My Show 1+1 movie ticket offer. How does this compare to Standard Chartered Ultimate?

@Ajay,

Hi, can you please suggest if it’s worth renewing the Axis Vistara Infinite Card by paying ₹10,000.

If yes, please let me know your viewpoint(s) and the benefits.

Dear Sir,

10K Club Vistara points on spend of INR 1L in 90 days

Is this every year or only first year?

Which more worth in terms of miles : Jet Airways or Air Vistara

Thank you 🙂

@AJ,

Did you manage to receive the upgrade vouchers with the Axis-Vistara Infinite Card. When I log-in, it shows CV Gold status, I have received 3 Business class vouchers also basis spends, but have not received upgrade or lounge vouchers. Have you received them?

@AJ,

So will we be receiving the upgrade vouchers in the welcome kit that we receive from Vistara in case we take the Infinite variant of the card?

@Shubham there is no welcome kit sent by Vistara. But yes, they do send these vouchers out when one attains a certain status with the airline.

Hi ajay,

Having huge issues with the axis infinite vistara card. Got it when heard about it on your blog. For some reason I cannot use the business class vouchers accumulated on my spend as every time they tell me the fare class is not available even when almost the entire business class is free. Get a feeling I have been taken for a ride.

When are you writing your usual annual card plans? What are cards you plan to have in 2017?

Hi Ajay, I got this card a few months back after reading your post about it. Overall I am happy. There is one big disappointment though. You don’t earn any miles on EMI transactions on Flipkart, Amazon etc. And no extra points to book Vistara flights with the card.

Apart from these 2 things, I like this card a lot.

What about foreign transaction fees?

Mileage earning is quite poor. 6/ 200 – most cards offer 8 (4/ 100). I recently became Vistara platinum (completed 12 flights in 3 months after status match). Don’t plan to apply as value for money is lacking. I usually fly Y in domestic, so business class benefit is notional.

Please review face value of these points ( 8/100 and 4/100). The ROI of the earn rate is highly competitive. Citi PMiles is 4/100 with each PMile @ INR 0.45 ( Total earn rate of 1.8%). Each CVP has a face value close to ~ INR 1. This 3/100 is 3%. Free BZ class tickets ( as mentioned by Ajay) take up the overall ROI to great levels!

I feel this is one of the better products in the market ( best for you if you are based out of Delhi/NCR since Vistara connectivity from DEL is great). Even I fly Y in Domestic however who in this wide world would not want to move up for ‘FREE’ .

All I want is accelerated rewards soon to add a cherry on this wonderful cake!

Jet co-branded cards (Amex variants) have higher earn rates than premier Miles card.

The redemption options, at least as of now, are quite limited. Business class redemption is 4x economy!

In any case, as mentioned above, a business class ticket is a limited benefit, as a bulk of people travel coach on domestic, including myself.

I still maintain my view – not a good RoI on the fee, unless there is higher earn rate, and is further accelerated for bookings on Vistara website

Annual Fees?

It has been already mentioned in the post as INR 10000.

I too have the Signature variant since I just wanted the bonus points and free ticket. Made sense at the time of signing up. Used the card a little for a few months and now stopped. The only issue I am facing and a serious issue is that Vistara from Mumbai has very less connectivity. So I used my points and ticket for Delhi return and now have kept this card in cold storage till Vistara starts direct flying more out of Mumbai. May not happen so soon, but yes for Delhi passengers/residents, its a good card. I shall second the negative point, that Axis bank provides little or no help with online checking of only credit card account, etc.