Back in November 2016, when the demonetization drive was at rolling out, PayTM saw this as an opportunity to spread their wings as a go-to service for both ends of the spectrum, including merchants and customers. They did get millions of new accounts as a result, but as a part of going cashless, they also opened up an unintended loophole for manufactured spending.

PayTM started to offer an opportunity to transfer your PayTM balance for a zero cost to bank accounts. Guess what that meant? One could essentially load up the wallet with a Zero Cost and transfer out the entire money. Rinse, repeat! While there were limits to how much money you could transfer in and out, it was an easy method to rotate money (term borrowed from PayTM).

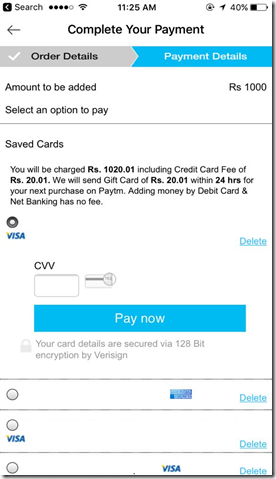

However, it seems PayTM caught on to this pretty quick and decided to shut it down! Essentially, they are not against you having to transfer funds out from your PayTM account to your bank account, but you can’t load up your PayTM account for free anymore with a credit card. PayTM will charge anyone who chooses to load money into their wallet with up with a credit card a 2% surcharge over and above the amount. Which means, if you want to load up INR 1000, you pay INR 1020 to PayTM going forward.

I’d like to point out, this charge is only applicable if you are expressly loading your wallet with a credit card. Let’s say you initiate a transaction to pay your phone bill for INR 1000, and you only have INR 500 in your wallet. The rest of the amount would be loaded up from your Credit Card without any charge. But let’s say you are in the habit of keeping your wallet stocked up with INR 1000 or INR 5000 or whatever amount you keep for sundry uses such as Uber, Swiggy and the likes, and you do this every 5 days or so, then you are going to pay this 2% fee.

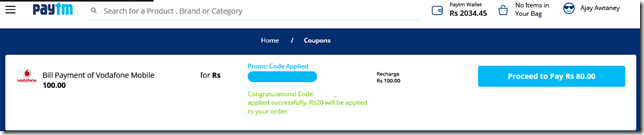

It isn’t so bad however. PayTM is going to reimburse you the fee as a coupon code which you can apply on your next transaction. For instance, I got an INR 20 coupon, and I was able to apply it on a transaction via PayTM to pay my Vodafone bill. You get the coupon only when you reload your wallet for more than INR 250, and it expires as of December 2017.

Here is what PayTM had to say:

As you are aware, in the month of November we launched a new payment platform for small merchants at 0% fee. Millions of merchants are accepting Paytm at their shops/establishments. They prefer to take money to their bank accounts and as a promise to democratizing payments, we made transfer to bank fee at 0%. This was extended to all our users as many shopkeepers/merchants also used their personal Paytm accounts to accept payments at their Shops.

This 0% transfer to bank fee left an opportunity to misuse this great service meant for our valuable customers. We saw a disturbing trend when many users started funding their Paytm wallet with their credit cards and transferring it to the bank all for free. They were not only getting free loyalty points which effectively is free cash but also getting access to free credit.

Incidentally, Paytm pays fee to card networks or banks whenever you use any payment instrument like any other online commerce company. Paytm pays a hefty charges when you use your credit card to card networks & issuing banks. If user simply adds money and takes to bank, we lose money. Our revenue model requires users to spend money within our network and we make money from the margins available to us on various products/services we offer.

You have to note, if you add money via Uber’s PayTM integration, you don’t have to pay the 2% surcharge that PayTM asks for.

Bottomline

While I agree PayTM would have been hurting with manufactured spending, there are always two sides to a story. I see where they are coming from and they want to make sure their systems are not abused. But other wallet companies in the country have done other approaches and they work fine for them. For instance, MobiKwik only allows you to withdraw INR 1000 per day from your account up to a maximum of INR 7000 or so. Freecharge does not allow you to put money in and get it out right away.

On another count, this could also become a revenue centre for PayTM at some point of time. I don’t think they’d be paying 2% MDR, given their huge volumes (176 million wallets, if I remember correctly) and hence the actual amount involved would be lets say 0.75% to 1%. But mine is a guess since I am not really in the payments business. Having said that, PayTM is perhaps banking on breakage. The system to get and redeem these codes is going to create friction, and perhaps people would forget about using the codes at some point of time.

Overall, I like the fact that the company is not mincing their words and calling a spade a spade! However, I’m hoping they don’t lose customers because of this.

There are manufactured spending loopholes for debit cards as well.

1. Axis Priority debit card gives a cash back of 10% upto 2500/qtr

2. Indusind gives reward points which are as good as cash after you reach a critical mass.

Short of starting to charge for bank withdrawals they can’t do anything to stop debit card misuse.

Well, PayTM has clarified now that the charges would apply only if you transfer the amount back to your bank account, and not otherwise. So no one has to worry

Well it didn’t last very long, PayTM has suspended the charge 😀

https://blog.paytm.com/we-will-introduce-new-features-to-prevent-credit-card-misuse-in-add-money-4c59fbfe017f

They will come up with new features which I suspect will be charging the transfer of money to bank accounts which actually makes more sense.

Well that was fast: https://blog.paytm.com/we-will-introduce-new-features-to-prevent-credit-card-misuse-in-add-money-4c59fbfe017f

Credit card MDR is atleast 1.25% and much higher for premium cards.

I have never transferred money from paytm to bank account. I will still have to pay 2%. Fortunately, there are many more wallets i can use. I am definitely not paying 2%.

And the coupon also has a problem. Normally there are several offers where you can use promo codes. I guess you can’t use 2 codes in 1 transaction. Even if you can, it’s a hassle to keep track of.

Didn’t feel that they’ll realise it so soon 🙁 I had converted my wallet to VIP, just to transfer 5k extra.

You can also use the money to send payment to your family and vice versa. Eg. You send money to wife Rs. 10000 via PayTM and it enters her bank account eventually. She uses your add on card and through her PayTM sends you 10000 which eventually reaches your bank account. This can be endless. You usually get about 2% back in credit card transactions. So you are actually earning 2% and reaching spend thresholds.

I know many friends who used manufactured spending to reach their spend threshold on some cards which got them huge benefits ;). Looks like all these guys in India, blindly and mindlessly start something new and later realize that its actually being used for something very different. They are always in a rush to cash in on any new opportunity and realize later that they have been fooled. I am also going to try this method.