India is currently getting ready to roll out the Goods & Services Tax with effect from July 1, 2017. Currently consumers in India have to pay multiple taxes at different rates. These taxes also differ from state to state. The idea behind introducing the GST is to simplify the current complex tax system.

The Goods & Services Tax (GST) is a consumption based tax levied on sale, manufacture and consumption on goods & services at a national level. This tax will be substitute for all indirect tax levied by state and central government in India effective July 1, 2017.

The slabs for GST in India vary between 0 to 28% where essentials like food commodities are not taxed. On the other end the highest level of 28% GST will be levied on luxury items like cars and perfumes. When the new tax slabs were introduced, the finance ministry had set a flat 28% GST rate on hotels charging INR 5,000/ USD 75 for a room night.

However, three days back a revised slab based on room rates was introduced. Effective July 1, 2017 hotel rooms priced between INR 2,500/USD 38 and INR 7,500/USD 116 will have an 18% GST levied and all guests staying in rooms priced above INR 7,500/USD 116 have to pay a 28% GST rate.

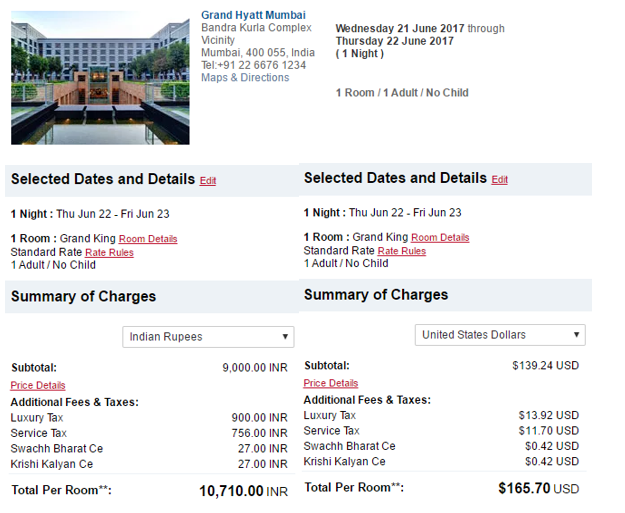

What taxes do I currently pay for a hotel stay in India?

To understand the impact of the new GST rates, let’s take a look at the current tax structure. Presently there are 2 separate tax components levied on your room rate:

- Luxury Tax : This makes up 10% of the room charge in most states. This being a state subject a lot of variation exists. For instance, if you stay in Tamil Nadu, it is chargeable at 12.5%. Some however charge it on the rate of the room you booked, and others charge on the rate of the room you stay in. For instance, if you upgrade your room in Delhi on the back of a Hyatt DSU, you pay the luxury tax on the published rate of the suite and not the originally booked room.

- Service Tax : This is a 14% tax levied on 60% price of the room tarriff. For instance, if you currently book a room for INR 10,000 the service tax applicable will be 14% on 6,000 making the charge INR 840.

- Swachh Bharat Cess : This is 0.5% charge on 60% of the room rate.

- Krishi Kalyan Cess : This is again 0.5% charge on 60% of the room rate.

In total the Service Tax + Krishi Kalyan cess + Swachh Bharat cess makes up a total of 15%. Therefore under the current system we’ve all been paying about 21% taxes on our room nights. Some estimates put a usual hotel stay to be 18% to 22% of current rates.

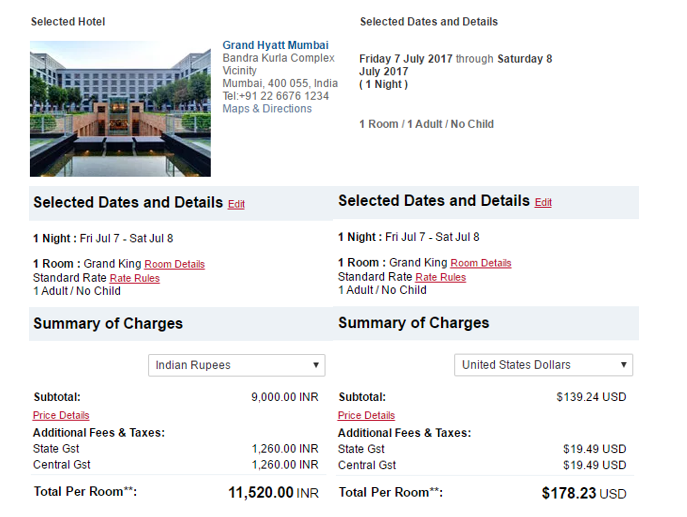

How will the new GST affect my hotel room rate from July 1, 2017 ?

Now effective July 1, everyone will need to pay one GST charge instead of four separate taxes. And depending upon how luxuriously you want to stay you will either pay an 18% or a 28% tax rate.

While this is good news for everyone who stays in budget and mid-range hotels as you will save at least 3% of your money. The luxury traveler will now have to pay more as the taxes will have increased to 28%.

I did a rate check at the Grand Hyatt in Mumbai to see how a night stay will impact my pocket before and after July 1,2017. It appears that a room night priced at INR 9,000/USD 140 will cost me INR 810/USD 13 more this July on wards. As you go upwards on suite bookings that cost on an average INR 20,000/USD 310 a night this differential will only increase and you land up paying almost INR 3,000/USD 47 more for a weekend stay.

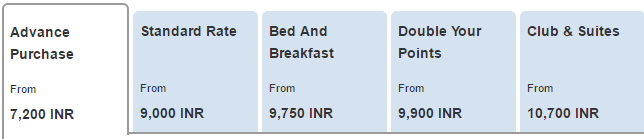

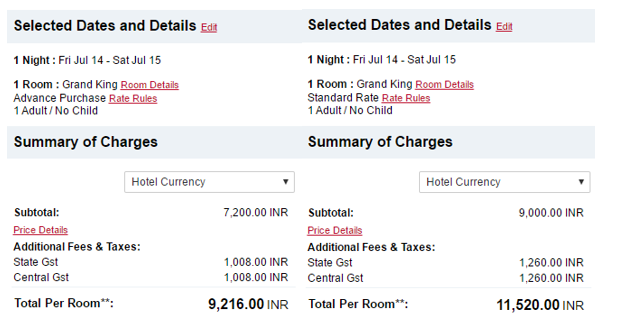

What GST rate do I pay if a hotel has two rates published ?

One thing remains unclear at this point of time is that if a hotel quotes the standard rate for a room above INR 7,500/USD 116 and the Advance purchase rate(APR) is less than INR 7,500/ USD 116 then what GST rate will be applicable. I would imagine that the GST will be charged on the actual invoice amount and should be 18% in case I book the APR. However, when I calculated the tax percentage for the Grand Hyatt in Mumbai it turns out that currently 28% GST is reflecting on all room rates.

My hope is that the GST rates would get revised on the lower priced rooms or perhaps for ease of taxation the APR might be increased to INR 7,500/ USD 116 . Some chain hotels in India like the Marriott have presently removed the tax break down completely with just a mention that room rates are exclusive of applicable taxes.

Clearly one positive of the GST is that the taxes will now be simplified and easy to understand for everyone and for a lot of budget travelers the 18% rate is a real saving. Though the downside is that indulgent travelers will feel the pinch with the extra we’ll have to pay. A room night at most luxury hotels is priced at an average of INR 10,000/ USD 155 upwards. Also if you are a foreign traveler planning a long vacation in India, it’s time to look at your hotel options or revise your stay budget.

Are you GST Ready to pay more if you love your luxury stays as much as we do? We clearly see this as being disadvantaged to other countries such as Singapore and Thailand where the taxes are lower by at least 10%

If i am correct 28% is charged on rates above Rs7500 otherwise its 18%?

I get promotional rates below Rs5000 at times at a certain hotel group but its still being taxed at 28% is this right?

@DJ it appears that GST is calculated on room’s standard published rate

India is becoming more and more tourist unfriendly , with this double gst tax it’s getting worst. already tourists have to bear with severe pollution , false publicity of goods and services , touts of all sorts , better visit SE asian countries , one gets a better deal

chandra

I agree absolutely. During our recent visit to India from States, we were shocked to learn that how expensive the hotels have become. There is plenty of false advertising where 1-2 star hotels are being advertised as 4 star hotels and priced as such. There is no reason for us to come back here when a hotel stay now costs 1.5-2 times more than in US and the quality and service is way much inferior. Good Luck India! During our recent stay at Taj resorts hotel Agra which was advertised as a 4 star hotel and priced as such, we found the inside of the hotel very filthy and unhealthy. One star hotels in US are better than this hotel.

@Sam I disagree with the quality of service you mention. I’ve stayed at a lot of American hotels, and there is nothing called service there. So there is no comparison I believe.

We live in UK and have been regular visitors to India for over 15 years but this increase in tax on anything better than a half decent hotel room means that we are now looking at alternative destinations in Asia. The visa applications are expensive and time consuming and this extra tax on tourists will discourage people from visiting a wonderful country. This is a huge shame!

Great Analysis. What happens to redemption rooms, rooms which we get for points? How are they taxed?

WTF, Why double taxation at same rate, State GST & Central GST? Wasn’t the whole purpose of GST was to have just one country one tax system?

How would this affect the OTA’s such as MMT, Yatra who often discount by as much as 70% on hotel rack rates?

Wait & Watch !!

GST is still one tax system, the total tax collected will get split between state and centre equally.

There is no double taxation. SGST & CGST are both part of GST, i.e., the states & centre share GST revenues

Great analysis. And thanks for the heads up.

Thanks for this analysis and explanation. Is there any guidance regarding the tax issue you mention where previously the end tax was based on the occupied room (as in your DSU example)?

I’m staying at the Park Hyatt Hyderabad shortly and used a DSU on an advance purchase rate below INR7500. In the past tax would have been based on the rack rate for the suite. Is that still the case, or is it purely on rate?

No, I can confirm that it won’t be a problem. Don’t worry.

Enjoy your stay.

@Jason this is a developing story. I am not aware how it will work out. So I’d advise you to let us know what you experience.

Another reason not to go…. ridiculous visa fees, over the top tourist tax, poverty beyond belief ( which they do nothing about ), over-crowded and filthy ( never seen so many rats scavenging but the Indians are used to living like that I guess ). And now a GST at a rate the likes of which the world has never seen. Get a grip India. You want to drive people away. It’s India. As if we don’t have enough reasons not to go, this just tops it off for me.

Sri Lanka here I come.

Troll is obvious.

@Robbo you are more than not welcome around here anyways. Thanks for the rant.

Glad we visited India in Jan/Feb. This doesn’t look good for luxury hotel stays.