A few weeks ago, we wrote about the best JPMiles earning credit cards for beginners. So, we thought it would only be the right thing to round up the best JPMiles Earning cards for the frequent flyers as well. With the most number of members for an Indian loyalty program, JPMiles are clearly one of the most popular mileage currencies around India. Here are some of the best credit cards in India, which award you JPMiles for your spends.

There are multiple ways to earn JPMiles, but one of the fastest ways to earn is the use of credit cards. JetPrivilege & Jet Airways have been co-brand partners with 4 banks over the years to issue credit cards. There are over 15 cards to choose from, and here are the ones which come with some of the best benefits or the fastest accrual rates to ensure you can get your next redemption flight faster.

Remember, you can have more than one co-branded credit cards, and you can keep them all for various benefits that each one brings. Not to forget, just having a co-brand card brings you the benefit of getting a 2-year extension on your JPMiles’ expiry date.

We headed to the JetPrivilege Cards Portal to compare all the options and find the best credit card to earn JPMiles.

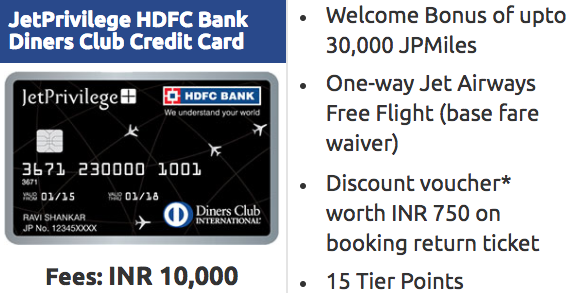

JetPrivilege HDFC Bank Diners Club Credit Card

Top of my list of credit cards to have in your pocket is the JetPrivilege HDFC Bank Diners Club Credit Card.

This card has the best earning ratio for tickets booking on Jet Airways. You get 24 JPMiles/INR 150 for booking tickets directly with the airline, and you get 15 Tier Points in the first year. We’ve used this benefit in the past, having used the 15 Tier Points to tip Shipra over to Platinum in a particular year since she did not have enough travel that year. Additionally, she gets 1 tier point every 150K INR of spend.

Not just that, you get 30,000 JPMiles on signup (15K on activation, and 15K on completing minimum spend). Being a card on the top end, you get complimentary lounge access at over 700 lounges across the world, which means the card works for you anywhere in the world, rather than just in India.

Ahlan Business Class Lounge at Dubai Airport, accessible with JetPrivilege HDFC Bank Diners Club Credit Card

The INR 10,000 fees pay you back more than enough with the JPMiles you receive, and unlimited lounge access as well.

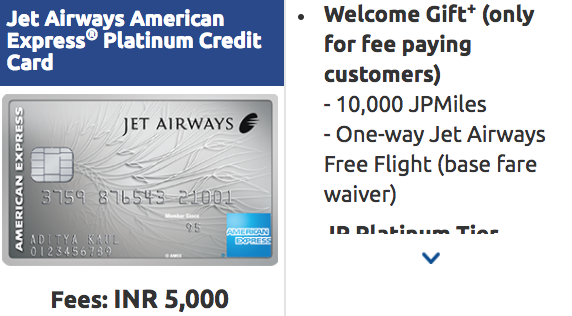

Jet Airways American Express Platinum Credit Card

Jet Airways American Express Platinum Card is one of the best cards out there, given the benefits, it comes with. For the INR 5,000 initiation fee you pay, you get 10,000 JPMiles to start and another 2,500 for applying through the JetPrivilege Cards portal.

Additionally, the Amex Lounge network across India gives you access to 13 lounges in 11 airports across India. This includes the American Express Lounge in Delhi T3, which is my pitstop every time I am passing through T3, given its proximity to the boarding gates, and fresh prepared a-la-carte food.

This card becomes available to everyone who earns INR 6 Lakhs and above per annum, so the entry barrier is not very high, and you can get instant approval when you apply for this card via the JetPrivilege Portal.

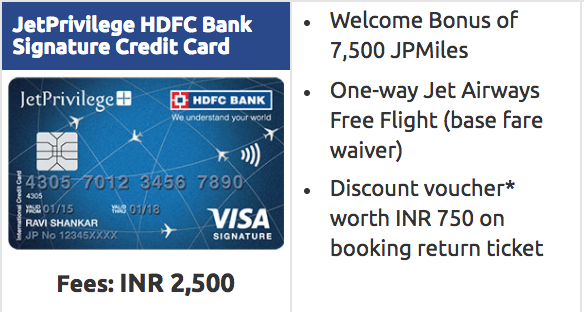

JetPrivilege HDFC Bank Signature Credit Card

This Credit Card comes handy for those with India’s largest Bank, HDFC Bank. They are the only ones with a tie-up that includes added tier points for spending, which means you get to your next tier faster on JetPrivilege.

You get 7500 JPMiles for signup, which means 3 JPMiles per INR spent on fees, but do not forget that you also get a Priority Pass with 5 free visits to over 1000 lounges worldwide.

The price/performance ratio of this card is good enough to put it in both our beginners’ list on account of the price, and into the advanced list given its capability to earn tier-points as well as the lounge access features enabled via Visa Lounge Access and the Priority Pass.

Bottomline

You can mint miles for your meals and for your travels, all in one go. All these cards provide some of the best rate of earning JPMiles, free tickets every year to cardholders for Jet Airways, and added free tickets across JetPrivilege partner network via all the miles you earn on the tickets. Golf, Movies and Hotel privileges come along, as well as the ability to get extra baggage allowance on your flights. Enough to make them on our list of the best Jet Airways / JetPrivilege co-brand cards for those who jet-set every day.

Apparently HDFC is moving to visa from MasterCard. So they upgraded/changed my jet privilege world card to Jet privilege Visa Signature. There’s a new cheapshot in their terms and conditions. You need a jet airways boarding pass to utilise their domestic lounge access!!!! It has been made mandatory. This is nuts!

This has just happened to me, and I can now appreciate how much of a climbdown it is. Firstly, MasterCard had more available lounges as compared to Visa, so it is already bad to have MasterCard replaced by Visa. And then, one now needs a Jet Airways boarding pass. This is terrible. Since I can’t often find award flights on Jet AIrways when I need them, I would be happy to change my (lifetime free) Jet Privilege Visa Signature Card by a (lifetime free) Regalia card. How does one ask for such a change?

AJ,

Shipraji has had the HDFC Jet Diners for quite some time I understand but dont you think that given that the first year is over, Infinia would be a better card even if JP Miles are the currency desired. Smartbuy gives you 10X (33% RP yield) and even if it is phased out MMT would give you 5X (16.7% RP). Mind you this is pre bonus and Jet frequently gives 25-50% bonus. So you could have between 20%-25% yield assuming 5X and 42-50% yield in miles assuming 10X. Plus, apart from Jet purchases, you would get 5x/10x RPs on Jet travel bookings and a number of other vendors (Snapdeal, Bigbasket). Plus 3 PPs, conversion to a few other travel partners and greater acceptance?

What do you say?

Regards

Just wanted to ask- does infinia actually have 10X programme? I thought that was only.for diners.

Btw, any idea about eligibility criteria for infinia? preferred customer and have sister working in HDFC, but not eligible for diners black due to its stringent criteria. Wanted to know if same is case here.

I have had a lot of issues with American Express. Their requirement of 6lacs was easily surpassed but they still refused to give the card. It’s been 4 months now after receiving their letter denying the card I have gotten 3 follow up letters which state I haven’t submitted my documents which I did twice. Plus phone calls inquiring about my interest in their card atleast once a week finally after 5 calls the lady recognised my voice and said sorry sir I’ve called you again and the last time you stated that you are no longer interested. I then applied with hdfc and voila application approved and card arrives within a week for the diners club card with one phone verification call and and one sms verification.

If you are a Jet Platinum member, the procedure is hassle free currently. You only need to give them a copy of your Platinum card, thats it.