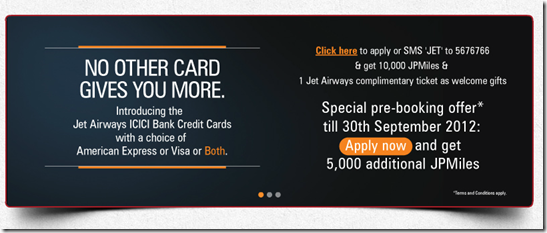

If you guys have been tracking closely, Jet Airways recently partnered HDFC Bank and ICICI Bank to launch a new range of co-branded credit cards. ICICI Bank is giving out a joining bonus of upto 10,000 JP Miles depending on the tier of the credit card you go for. However, if you apply up to 30th September 2012, you also can have a 50 % bonus on your welcome miles.

- Sapphiro:10,000 JP Miles + 5,000 bonus JP Miles

- Rubyx: 5,000 JP Miles + 2,500 bonus JP Miles

- Coral: 2,500 JP Miles + 1,50 bonus JP Miles

All the cards come in an American Express version and a Visa version, and you can have both versions for the same fees, which I feel is a sweet deal, considering you can also get in on the lucrative JP Miles accumulation you can do on the Amex version of the card.

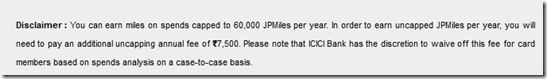

There is a new fee that got announced of Rs. 7,500 per annum which was required to be paid to get unlimited JP Miles on the card. Under this, you could only earn upto 60,000 JP Miles on the top-end card for instance in a year, but I talked to ICICI Bank and they clarified that if you were doing ‘genuine’ retail spend on the card, they would be happy to uncap your card’s mileage accumulation for free after reviewing your spends.

I’ve heard from readers that ICICI Bank is not up to the mark in customer servicing as of now, and clueless marketing people turning up at your doorstep. So, if you are thinking about getting the card, maybe it is a wise move to ask for it within the week, rather than after to also get the bonus miles as well, and make sure the contact centre is clear about your requirements rather than turning away a clueless salesman from your door. I haven’t heard of fee waivers yet, so maybe there are no such promotions in mind at present to give the card away for free.

I haven’t had the time to publish a review on the card series just yet, but in a nutshell, it is a good card product to have, if you can ignore the customer servicing issues! ICICI Bank is not the best in that department yet.

Here is a post which I made about some clarifications on the card product. If you have more questions, feel free to ping me or drop a comment below and I will be glad to reply.

Related Posts:

- Jet Airways ICICI Bank Credit Card is better than the Jet Airways HDFC Bank CC

- Details out about the new Jet Airways ICICI Bank card

- Jet Airways’ HDFC Bank co-branded credit card does not raise the bar!

- Sunday Plastic: Jet Privilege HDFC Bank World Credit Card

Live From A Lounge is present on Facebook, Twitter & available via email, RSS.

@AJ, Has ICICI started issuing the cobranded cards. I did check with them a few days back and they said the upgrade process hasnt started yet.Thats real slow.

Tell me one thing most of the card only give points wherein amex also give additions like free tickets etc. on spend. Which is better?

@Agarwal, Amex is only issued in 3 cities in India. other cards are available at other cities as well, that is one big difference for most people who do not end up being eligible for an Amex.

Very poor customer service. What they meen by not genuine transactions.

@AJ,I still feel that Citi’s customer service will not be matched by Jet’s new partners..I dont know how many 9W patrons will get pissed off inadvertently

AJ I would love to have this card but I don’t have patience to deal with ICICI customer service. I submitted my application 2 days after they launched this card but nobody has yet picked up the documents. Reminded them a couple of times but it doesn’t help!

couldn’t understand the ‘both’ card. cant imagine a card with visa and amex on it? what did icici mean?

It means you get two cards linked to the same account, one on the Visa network and one on the Amex network