Last year, I managed to put together a worksheet where I wanted to be able to help you all compare the various mileage earning credit cards in India, as per your spend patterns. Since then, a lot has changed in terms of products out there in the market. Some of these included the launch of the SBI/AI credit card, and the scaling down of mileage earning on ICICI Bank Jet Airways credit cards.

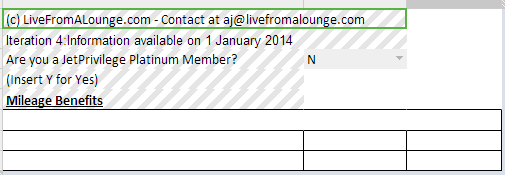

I’m now happy to put out version 2 of the worksheet, which you should be able to access via Google Sheets. Like always, here is a quick primer on how this works with a few simple inputs:

Step 1: You’d need to select if you are Jet Airways JP Platinum member or not via the dropdown menu.

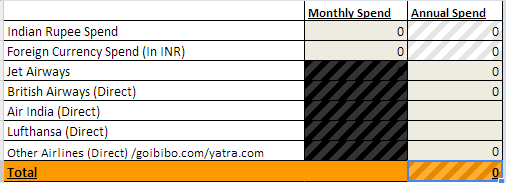

Step 2: Input your monthly spends via credit cards, split as domestic and international. Exclude your airline spend from here, because airline spend is to be entered specifically per airline in another column.

Output: Taking your inputs into account, the worksheet will give you 3 bunches of output to look out for:

a) Miles you could earn via the following credit cards: Citibank PremierMiles, Jet Airways ICICI Co-branded cards, JetPrivilege HDFC co-branded credit cards, Jet Airways American Express Platinum Credit Cards, Miles & More Lufthansa Credit Cards, ICICI British Airways CC, SBI Air India CC, Standard Chartered Emirates CC. Do let me know if I missed any (mileage earning) credit cards here.

b) Welcome miles for sign-up or annual renewal bonuses on these cards along with the cost per mile computation

c) Benefits such as Lounge Access, Upgrade Vouchers, etc. you’d receive from the banks on your credit cards.

Do let me know what do you think of this worksheet, and if I could make it better somehow. If there is a bug report, send it to me at [aj (at) livefromalounge dot com]

Happy Earning & Burning Miles in 2014.

Related Posts:

Join over 2600 people who check-in daily to find out about the best in travel. Free emails (once-a-day) | RSS Feeds | Facebook Updates | Twitter | Instagram

@Ajay in that case, what is the best credit card today?

57th row shows monetary value right?

If I go by your worksheet without considering yields on my average monthly spends and consider only flying costs, Citibank PremierMiles has the best cost-benefit ratio, isn’t it?

@Ruchir the worksheet needs change. Almost all cards have undergone some changes.

Cell C10 should be B10*12, but reads B11*12. This throws all calculations off.

Pls update this xls. thanks.

I am curious to know what is the best card …. Love the website

Can you please correct the number of lounge visits for the citibank Premier Miles and the 9W saphiro card.

What I posted is confirmed with support. In fact, it’s copy paste from there email reply!

Ajay, 27.5k miles comes every here. Bank says:

Offer 1: Annual Fee: Rs. 13,999.00; 27,500 Bonus miles every year on renewal with Annual Fee.

Offer 2: Annual fee: Rs. 3,000.00: Get movie and holiday vouchers for one-time use.

I cant force you to add the 3k version 🙂 But it makes sense for me.

Hi Rajiv. On the website https://www.sc.com/in/credit-cards/emirates-platinum.html it only talks about 27,500 bonus miles on payment of first year fees. can you point me to annual fees getting 27,500 miles as well?

It seems to me that the HDFC 9W MC Titanium has the lowest cost per mile,Even if I have the lowest spend.

Correct me if I am wrong.

@Raj, for each individual it may be different depending on how much you spend. The HDFC 9W MC Titanium may have the lowest cost, but it also has the lowest benefits like no lounge access, no free tickets etc.

I use the 3k fees option. Considering 27.5k miles is the only difference between the 2 options, I am pretty sure 27.5k miles comes in subsequent years too. I wonder why you are not considering the 3k option in the sheet.

@Rajiv, could you confirm with the bank and tell me if 27.5K miles come annually? The wording says “on joining”. I’ll go back and revise the sheet in this case. As for why am I not looking at the 3K option, in my view, I am trying to put as many cards there with the best offers they have, which in this case would be with the sign up bonus in my view.

SCB Emirates has 2 options. Rs 15k fees with welcome 27.5k miles & Rs 3k fees with no welcome miles. Also, for the first option, the excel needs to have the same 27.5k as renewal miles too.

@Rajiv only considering the 15K fees option here. Can you confirm that the 27.5K miles come every year? I’ve updated the sheet to reflect second year earnings of 27.5K as per your statement here.

It seems the Amex Jet airways fees is set to 0. Should be 10k + tax.

Can you make this spreadsheet read-only for others so that it doesn’t get vandalized?

@Shan, if I make it read only then no one will be able to use it as a calculator which beats the purpose.

As for Amex Jet airways, the fee is 10k plus tax when I check. If you put the Jet Airways Platinum Toggle to Yes, then it is offered free to you and hence the fees is 0 then.