I know it is a little late in the day to put out a round up for 2013, but I thought I’d do it anyways. I did not get the time to put a post earlier than this, but all I can tell you is we are lucky to be living in times when the mileage earning game is just about getting started in this country. And I am happy to be on board earlier rather than later. For the rest of you, miles and points are not just a silly hobby, but they can finance a lifestyle if you did all the right things.

For the longest time, for 10 years or so actually, India just had one major Mileage Earning Credit Card, which was the Citibank Jet Airways co-branded credit card series. This arrangement was dissolved in May 2012, and that was the birth of truly spectacular mileage earning game in India.

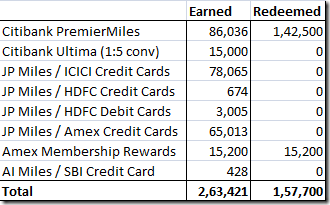

Lets have a look at all the cards I used in 2013, and what did I get with using them. This is a precursor to another post where I will put out what I expect to do in 2014.

- Citibank PremierMiles Credit Card (86,036 miles earned): Like you know, I’ve had this credit card since 2011, the MasterCard version, and in 2012, Citibank made this their primary credit card product in India after the disassociation with Jet Airways. This credit card continues to get most of my spend. In 2013, I earned 86,036 Miles on this Credit Card, mostly with personal spend and the promotions. And I used 3 redemptions from this card as well. I transferred 50,000 miles to Avios with their 30% bonus, another 76,500 miles to Singapore Airlines Krisflyer to get this beauty of a redemption from Los Angeles to Singapore/Singapore to Mumbai. I also transferred 16,000 PremierMiles to my Air India Flying Returns account to book tickets for friends and family, and to make sure these extended miles did not go waste. Of course, the results of the 50K miles are yet to come out, so we’ll if I am on that list or not.

- Citibank Ultima (3,000 Ultima Points equal to 15,000 airline miles earned): I did not write about it extensively at the moment, but in 2012, I picked up a Citibank Ultima credit card. While it came with 50,000 bonus JPMiles at that point of time, since this is a 2013 calender year report, we will stick to the 3,000 Ultima Points number which came due to spends on this credit card. These 3,000 points were transferred by me to my Air India Flying Returns account for 15,000 AI miles at the end of the year when I wanted to swap the Ultima for another Citibank PremierMiles (Visa).

- ICICI Jet Airways co-branded credit cards (78,065 miles earned): I started up with an ICICI Bank Jet Airways Sapphiro credit card last year, and due to the excellent mileage earning on this card for the whole year, I have to admit I gave them quite some business. After all, 9 JP Miles/ Rs. 100 spent internationally is not bad at all. There were 15,000 JP Miles towards the initial bonus, and the rest were miles earned for spending on the credit card.

- HDFC Jet Privilege co-branded credit cards (674 miles earned): I’ve said it before and I say it again. This credit card does not get much love from me because the mileage earning sucks. I am the guy who’d like to even pay a INR 50 toll with a credit card if that could be helped, but they don’t look at anything under Rs. 150 for consideration as spend for mileage earning. But the advantage lies for a lot of you who don’t live in the metros, and HDFC Bank would issue you a card there when Citi and Amex won’t.

- American Express Jet Airways co-branded credit cards (65,013 miles earned): I’ve loved this card from day one. Enough to be paying for it inspite of being a Jet Airways Platinum. Every year, for a short burst of time, Amex would bump up the welcome gift from 20,000 JPMiles to 30,000 JPMiles for signing up for this card. I earned 30,000 JPMiles via the signup bonus and the rest with my spends on this card.

- HDFC Jet Privilege co-branded debit cards (3005 miles earned): This is the first time an Indian bank tied up to launch a debit card which earned miles, and of course I wanted to have it. I got 1,000 miles for signing up for the card, another 2,000 for my first transaction, and 5 miles for the transaction. A lot of miles from various transactions haven’t yet posted so things aren’t as smooth on this card as they should have been.

- American Express Membership Rewards (15,200 MR): I had the American Express Gold Charge Card, but when they started charging me a fee for it, I did not want to pay for a card that I don’t use much. Hence I cancelled it. However, I transferred my residual miles into the British Airways Avios program, where I received 8,100 Avios + 2,430 bonus Avios. I also remember transferring some MR to SPG earlier in the year, but don’t have much memory of it now.

- SBI Card Air India co-branded credit cards (428 miles earned): I laid my hands on this card only right at the end of the year, and hence, the sign-up bonuses and spends haven’t really credited in the year gone by. I made some spend and I earned 428 Air India miles on this card. When a spend of INR 10 lakhs will be spent here, I’ll get Air India gold status.

In a nutshell, I earned roughly about 264K Miles/points last year only by spending money as I’d already do, but not spending cash or writing cheques. I also redeemed 158K+ miles, because I haven’t gone through the statements to see how many Jet Airways redemption flights did I take or gift my family last year.

This flexibility and democracy in earning and burning miles and points is truly the reason I love the hobby. We still might not be in for megabonuses such as those in the USA, but hey, we got to make the best of what we have!

How many miles did you earn from the comfort of your home or wallet last year?

[Also check out my post on which mileage earning credit card is the best for you in 2014. ]

Join over 2900 people who check-in daily to find out about the best in travel. Free emails (once-a-day) | RSS Feeds | Facebook Updates | Twitter | Instagram

Hi AJ, nice post. I started arnd mid-2012, with the SCB Emirates MasterCard since I was expecting future travel in Emirates, specifically targeting a Dubai trip with family. Over the time, I made 75k miles, 50-50 split between flying miles and card spends. Now planning the premier miles card.

Meanwhile, it would be great to know the fees you are paying for the above cards. Of course,can refer the google spreadsheet but do you plan those standard fees or manage to get some waivers?

@Rajiv, I pay for the PremierMiles, paid for the Ultima, Paid for SBI CC. Jet co-branded cards come free apart from Amex where I paid to be able to get 30K miles as launch offer.

Hi AJ quite a good scoring rate. I have done about 1.86+ lacs in total.

HDFC JET 45086 amex Jet 40912 , citi premier miles 58000+ Amex platinum travel 42000+

Thanks for all the tips that helps me earn few extra thousands miles.

Cheers…

Thanks for sharing AJ.

Did to transfer to SPG at 3:1 ? Is it worth it transferring at that ratio? Do they have transfer bonuses ?

@Varun yes I transferred at 3:1 to SPG. Needed to top up account. No transfer bonuses then.

wanted to know- in 2013 got both jet airways icici amex and visa sapphiro credit cards for Rs 5,000. now for renewal will it be the same- 5k for both cards or…?

@bansal yes. 5k for both

Wow. Thats some earning :D. You are an inspiration :P.

Meanwhile ,I am eagerly waiting for my 50k bonus premier miles.

Cheers 🙂