Recently, when I wrote about how I earned a boatload of miles while travelling on business last month, people asked me to elaborate on the credit cards I used to earn the points and how I optimize credit cards on travels. Like this comment,

Ma’am, it would have been helpful if you mentioned which credit card was used for which nature of the expense. Also, if all these earnings were JP miles or some other nature, for e.g. on the Citi Prestige card or Premier Miles.

Hope you can expand on the same.

I realise that while the spend to miles earning ratio comes naturally to me, without listing the card and the reason behind my choice of card it perhaps is a bit tedious to understand. So, in this post, I’m penning down my rationale behind the credit cards I use when I travel, to maximise my miles and points collection. I’m also hoping to learn from all of you if there is an opportunity to improvise my credit card usage and maximise mileage earning further. For the sake of simplicity, I have combined all the miles and points I earned in June and July.

Jet Privilege HDFC Bank Diners Club Card (Earned 26,100 JPMiles with this)

Out of the many cards I stock in my wallet, I use two cards, a lot when I am on the road. When flying Jet Airways, I book all the tickets with my Jet Privilege HDFC Bank Diners Club card. Like I’ve mentioned before, this is a great card for earning JPMiles. The card earns me 24 JPMiles for every INR 150 I spend on booking JetAirways tickets.

We also have the HDFC Diners Club Black card in the family and Ajay is a big fan. While booking tickets via a partner OTA will get me 10x reward points; i.e. I can earn 50 JPMiles for every 150 rupees spent, I prefer direct booking with the airlines because my travel plans are kind of last minute and having flexible cancellation and amendment is important to me, without paying hefty money for these. As Jet Airways Platinum tier, I am eligible for change and cancellations on most fares when booked directly with the airline. That is the tradeoff, hence, we accept for booking work trips.

Booking the two round trips to Hong Kong last month earned me 15,600 JPMiles and the round trip ticket to London in June got me another 10,500 JPMiles. Therefore apart from the 40,800 JPMiles I got boarding the aeroplanes, I also earned myself an additional 26,100 JPMiles from booking those plane tickets for myself.

Citi Prestige Credit Card earned me 2,936 Prestige Points = 19,000 Miles

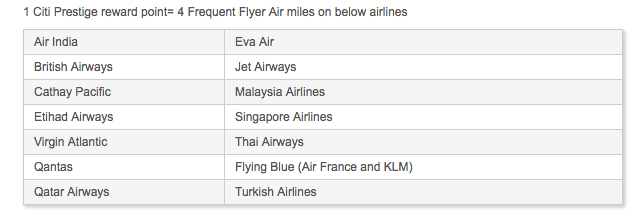

In order to keep things simple, I usually earmark one credit card for all my travel spends. This includes hotels, eating out, taxis, trains and even shopping. Now Citi Prestige has been my choice of card for these spends for two reasons. First that it earns me 2x points on International spends which means that instead of earning the regular 1 Prestige point, I get an opportunity to earn 2 Prestige points overseas. If I convert that into miles, then each Citi Prestige point equals 4 miles that I can choose to transfer across 14 airlines.

| Spend Type | Citi Prestige Points | Airmiles |

|---|---|---|

| London Airbnb (INR spend) | 844 | 3376 |

| Commute in London | 180 | 1440 |

| Eating out in London | 94 | 752 |

| Shopping in London | 55 | 440 |

| UK Visa (INR Spend) | 275 | 1100 |

| Hong Kong Hotel | 762 | 6096 |

| Commute in Hong Kong | 63 | 504 |

| Eating out in Hong Kong | 438 | 3504 |

| Shopping in Hong Kong | 225 | 1800 |

| TOTAL | 2936 | 19,012 |

The other reason I like to accumulate points on this card is the versatility of points transfer across multiple airlines.

Plus in the past, they’ve run pretty lucrative conversion bonus offers such as 50% bonus on converting Citi points to BA Avios, I did manage to make good of this promotion and transferred all my Prestige points to BA Avios. The versatility of Prestige points, the acceptability of the VISA network and the fact that Prestige points don’t expire make it a great choice for a travel and lifestyle credit card.

Bottomline

I earned more than 90,000 miles and points over the last two months. Of these, I earned more miles, 45,100 miles on the ground from spending on my credit cards than from flying up in the air which earned me 40,800 JPMiles.

Additionally, on one of my trips to Hong Kong, I stayed at Ovolo, a hotel brand that participates in the Starwood Preferred Guest (SPG) program. Not only did I earn miles by paying for the stay on my Citi Prestige card but also earned over 5,000 Starpoints by combining Starwood promotions. 2,000 points just came to me because I was staying at an eligible hotel which had participated in the SPG More Nights, More Starpoints promotion.

While I’m happy about it, I’m also re-evaluating my credit card strategy. I want to keep it simple yet maximize the mileage earning opportunity. This is unlike Ajay, who literally has 20 cards in his wallet and pulls them out trying to think which one to pay on for which expense.

I’m wondering if there is another credit card I should add to my wallet? What do you think…

How long does it typically take for converting Citi Prestige to Airmiles? Website says 3 weeks but I presume this is the maximum period. Perhaps your experience transferring to BA Avios might help.

Hi Shipra,

Following your article I thought It would be an awesome opportunity to earn 3X JPmiles by using my Jet Privilege HDFC Bank Diners Club Card to book flights to Singapore. So I went ahead ignoring instant discount offers (upto 1000 off on base fare on some OTA sites) and booked directly on Jetairways website on 31st July. Unfortunately my joy was short lived when I received the statement on 4th August.

For flights booked worth 69100 INR, I received only (69100/150)x8=3685 JPMiles instead of 3X which should have been (69100/150)x24=3685 JPMiles=11040 JPMiles.

So I called up Diners Club Support and they told me, the rest of the miles i.e. 11040-3685 = 7355 JPMiles will be credited in the next billing cycle i.e September 2018!

So just wanted to know from you, if it was the same case with you? Did you get all the 3X JPMiles in one single shot in a billing cycle or was split in 2 billing cycles?

Thanks for your article, keep them coming!

Tanmay.

Hi Tanmay,

Thanks for sharing this. The 3x JP Miles have so far been credited in the same billing cycle, however, I notice the same discrepancy for July like you mentioned. Have flagged this to HDFC now.

Hi Shipra,

they did not credit the balance JPMiles in this months statement too. 🙁

Check your statement as well.

Regards,

Tanmay Broachwala.

Why would anyone who qualifies for a Chase CSR card get any of these cards? No forex fees + 3x points for travel and dining + great travel insurance.

@Boraxo because this is not the USA and we are not Americans. There

Just curious: don’t these credit cards charge an international spend fee of like 3-4% anywhere outside India?

The value of miles earned would be net of those fees in that case.

Hi Kumar,

On work trips, it’s a mess for me to spend cash and save all the bills to claim later. Also, not the safest way to travel with a bundle of cash.

Having said this, this is a question that has been on my mind as well So, during my last trip to Hong Kong I compared the currency exchange rates at various points.

Day exchange rate was: 1 HKD = 9.75 INR

Book my Forex offered me: 1 HKD = 10 INR

Rate at Mumbai Airport was: 1 HKD = 10.75 INR

Rate at HK Airport was: 1 HKD = 12.6 INR

I withdrew HK Dollars from an ATM at the rate of 1 HKD = 9.03 INR

The very same day I used my Citi card to buy the train ticket and with the 3.5% fee the conversion rate was 1 HKD = 9.10 INR

I think Amex Jet Privilege Platinum Amex Card because it gives access to Amex Delhi Lounge to startwith. Also it is free on Jet Platinum Tier and you need to have 1 Amex cards as well. For some who does not wish to pay fees of Diners it is a great alternative.

Also the Citi Prestige has fees. As Jet Platinum tier one can get Jet Airways ICICI Bank Sapphiro VISA Credit Card. The Jet Miles earnings are similar to Citi Prestige 4 miles per Rs 100. Ajay has reviewed them here.

what happened to Ajay’s Iberia Avios flight purchase promo?

@VK still not credited for us.

FYI you Jet waives off cancellation/change fees for Plats even when booked through a OTA. I’ve used it multiple times when booking through Smartbuy+Cleartrip.

seriously? I didn’t know that. But how to cancel a booking we have done using smartbuy with jet airways?

Assuming you have booked through Cleartrip, call them to cancel the booking and when they mention cancellation fees, tell them the airline penalty needs to be waived off since you’re a Platinum member. They will check their backend, confirm the same and issue a full refund.

Works even when booking via hdfcbankdinersclub.in

Of course you need to check booking class on jet airways site or app.

S&S