[Ed’s Take: This is a story that had to be told. We started going around this all of September, trying to piece this together. Enjoy the read with a cup of coffee/tea!]

Air India currently has a fleet of 124 aircraft excluding subsidiaries. The fleet comprises of 22 Airbus A319 aircraft, 34 A320/A320neos, 20 A321s, 4 Boeing 747-400s, 18 777s (ER + LR) and 27 787-8s. Here is an inventory.

- Out of the 34 Airbus A320 family aircraft, 4 aircraft are a part of the classic series and are retired (AvGeeks, remember those double-bogies?). Another 7 Airbus A320neos will join the fleet by 2019.

- Of the 18 777 aircraft, 2 are back returned to Boeing for the retrofit them for VVIP operations. Of the 4 747s, one aircraft is stored at Mumbai airport without engines and 3 are currently used for Hajj flights. When not used for Hajj flights, they are used as Air India One (India’s President, Vice President & Prime Minister) and the Hyderabad-Jeddah and Hyderabad-Mumbai routes. Sometimes, Air India schedules the Queen of the skies on Mumbai-Delhi and Delhi – Kolkata routes as a capacity addition during peak season.

So technically, Air India has a fleet of 118 aircraft for daily operations.

Boeing 777 family

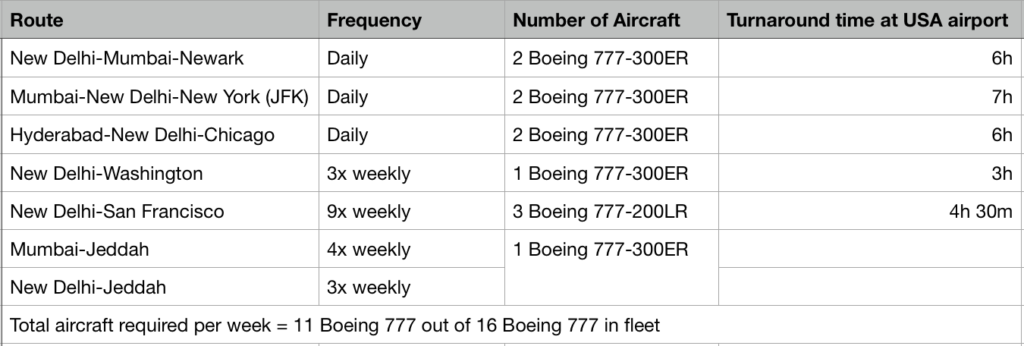

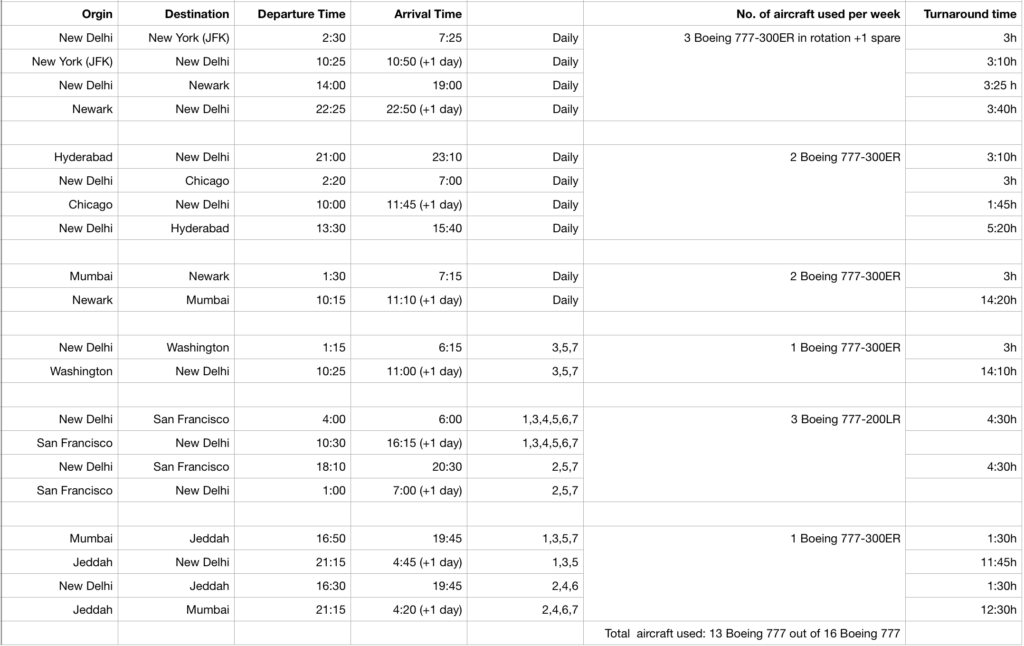

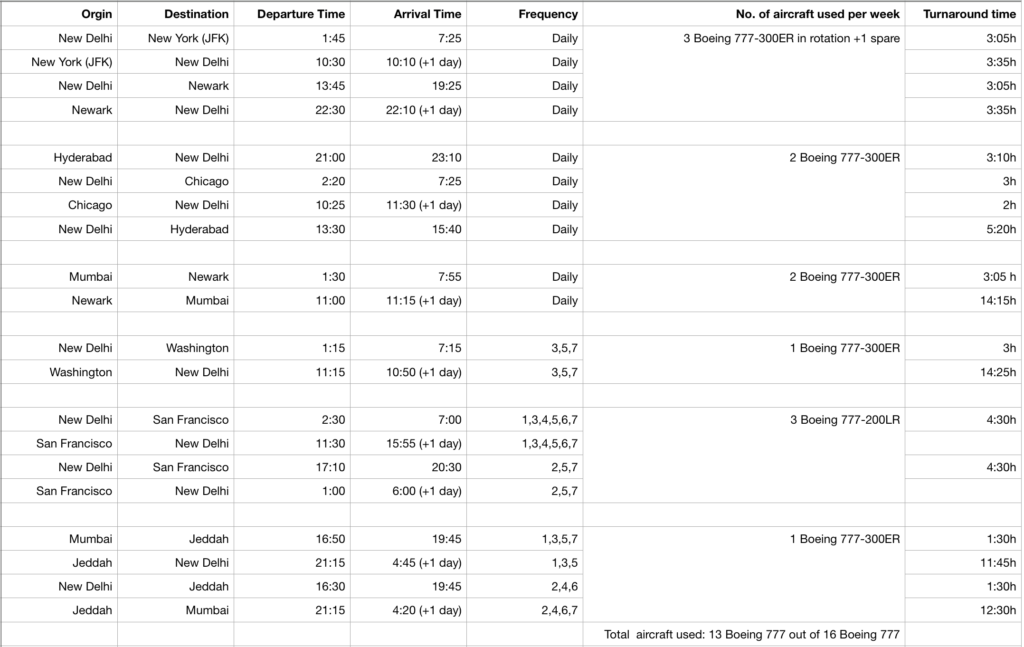

Air India has a fleet of 13 Boeing 777-300ER and 3 777-200LR aircraft, which they use largely for the USA routes. Air India also deploys them on Mumbai-Jeddah and Delhi-Jeddah routes apart from some Hajj flights. This is how Air India’s network works out with the 777s:

Sometimes the 777-200LR is used on Delhi- New York JFK or Delhi – Chicago and the Boeing 777-300ER on the Delhi-San Francisco, but that’s just rotation.

A singular Boeing 777-300ER is currently being used for Hajj Operations, but that is seasonal. Air India will soon launch a 3x weekly Mumbai-New York (JFK) flight using a Boeing 777-300ER aircraft. Even after that, the ultralong-haul operations still leave 4 Boeing 777-300ER aircraft, not accounting for the Hajj operations. We account for the fact that you would need aircraft on standby to account for maintenance and unforeseen delays. For instance, when some of their aircraft are infested with bedbugs.

One of the first things for an airline to do to make money is to have a network for maximising efficiency. But looks like Air India didn’t get that memo.

Air India could really restructure their 777 operations to maximise aircraft utilisation. Reducing time spent by aircraft on the ground, especially at USA destinations could free up aircraft, which could then be used for increasing frequencies.

Here is one instance of how the airline could optimize its timetable.

Even when you account for 1 Boeing 777-300ER which will be used for Mumbai-New York (3x weekly) service, Air India still has a couple of Boeing 777-300ER aircraft free for substitutions.

Additionally, Air India still can add more flights as their 777s stay on the ground for 11-14 hours on some routes. Like how about, a New Delhi – Newark daily by cutting down the halt at New York (JFK) on New Delhi – New York (JFK) route and the tag flight from Mumbai can be operated by another Boeing 777-300ER.

Boeing 787-8s

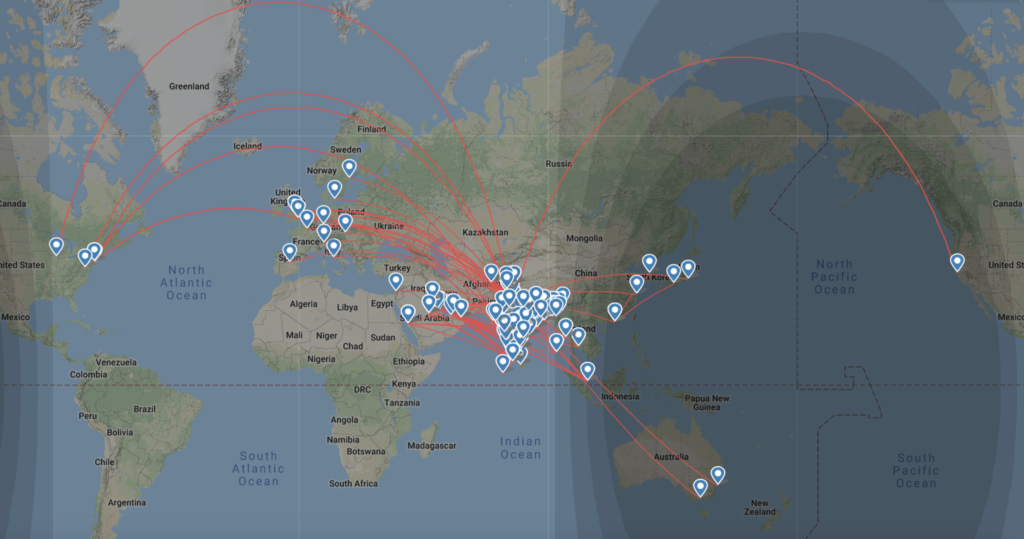

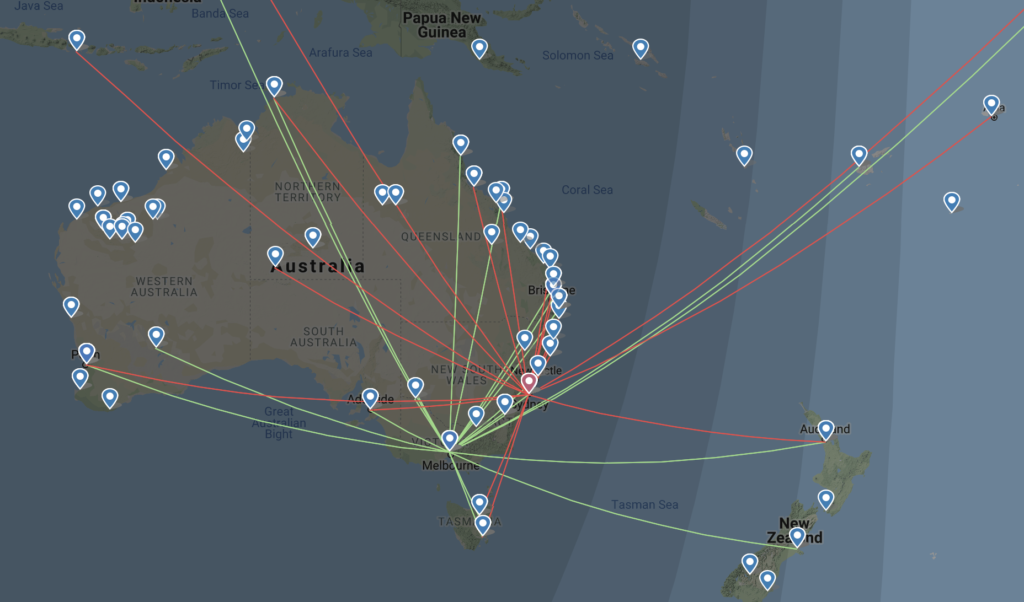

Contrary to the 777 fleet deployment, Air India has done a far better job with utilising their 787s. They are the backbone of Air India’s Europe and Far-East network. They are also used for flights to Australia as well as some Middle-East routes and domestic tag flights.

Currently, VT-ANK is out of service for maintenance and VT-ANO will start operating from October 7, 2018. For any given week, Air India utilises 22 Boeing 787-8 that leaves 5 Boeing 787-8 on the ground. One will be used for the upcoming Mumbai-Frankfurt route, so Air India still has 4 Boeing 787-8s to spare. With the Birmingham route seeing service reductions to 6 weekly services (3x Amritsar and 3x New Delhi), the aircraft utilisation will drop further.

Will they launch another route like Mumbai-Nairobi which has been long overdue with the additional aircraft? Or take up Mumbai-Brussels route as they did with New Delhi-Vienna when Austrian Airlines stopped operating the route? Or increase frequency on their Australia routes or on the London route?

Air India owns 6 Boeing 787s and 21 are leased. So think of it this way, Air India is only utilising their leased Boeing fleet while keeping the aircraft that they own on the ground.

Air India is essentially operating fewer frequencies to maximise the number of destinations they serve while underutilising their fleet.

New routes take time to mature. After a few months, or years sometimes, those routes are upgraded to daily service. Air India gets the first stage right but they sparingly follow up with capacity addition. For instance, another frequency to Australia just happened a few months ago.

Air India doesn’t have enough aircraft to operate daily service on all their routes but at least they can add more frequencies to some routes to effectively utilise their fleet.

Airbus A320 family

Air India has a fleet of 22 Airbus A319, 34 Airbus A320/A320neo and 20 Airbus A321 primarily used for their domestic operations apart from some international operations. Out of this fleet of 75 narrowbody aircraft, 4 Airbus A320 classic aircraft are already taken off the roster. Air India still has a few Airbus A320neos still left to be delivered which will join the fleet by 2019 end.

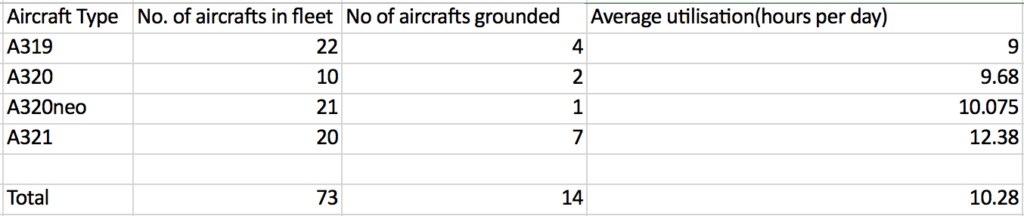

Currently, 1 Airbus A320neo, 3 A319s and 7 A321s are out of circulation. Which means 15% of their narrowbody fleet is grounded, which is a significant number.

If you look at their average utilisation per day, it is the lowest among Indian airlines. 6 Airbus A321 will start daily operations from the first week of October. There was a time in September 2018, when 1 Airbus A320, 1 A320neo, 2 A319s and 8 A321s were out of service. It represents 17% of their narrowbody capacity.

Air India won’t have a significant net addition to its fleet since the newer Airbus A320neos were ordered to replace Airbus A320 classic aircraft which were over 20 years old. Air India could improve their aircraft utilisation per day. I mean, just look at this data. IndiGo is clocking 17 hours of their birds approximately. Jet Airways is stretching at 14. So, what stops Air India?

Our Data was collected on the back of a snapshot earlier this week in October 2018.

Codeshare

Air India has added a lot of flights to Star Alliance member hubs in the past few years. They have added a lot of codeshares also. But they fell on short on a few important ones. For example, they added flights to Copenhagen and Stockholm both being hubs for Scandinavian Airlines. But did they enter into a codeshare agreement with them for flights out of those hubs? No. Why?

They added a flight to Melbourne and Sydney each but did they consider codesharing with Virgin Austraila out of these airports or with Air New Zealand for flights to New Zealand? Or codesharing with Thai for their extensive network out of Bangkok or ANA out of Tokyo? Or Austrian Airlines out of Vienna? The reason I am not mentioning Singapore Airline is that it will be a closed door once Vistara will fly internationally.

Don’t even get me started on Lufthansa as Air India codeshares only on a handful of destinations (17 destinations to be precise out of which 5 destinations are already served by Air India).

Air India needs to shift their entire European sector to a morning arrival in Europe if they want to enhance codeshares and successfully operate flights. It will help both passengers and themselves as passengers will get more options to connect to European as well as North and South American cities.

I don’t know what Air India had in mind when they went for an evening arrival in Europe as it is neither convenient for tourists nor businessmen nor connecting passengers. Which is perhaps the reason Air India is only looking at India connectivity and not connections at the other end.

Golden Opportunity

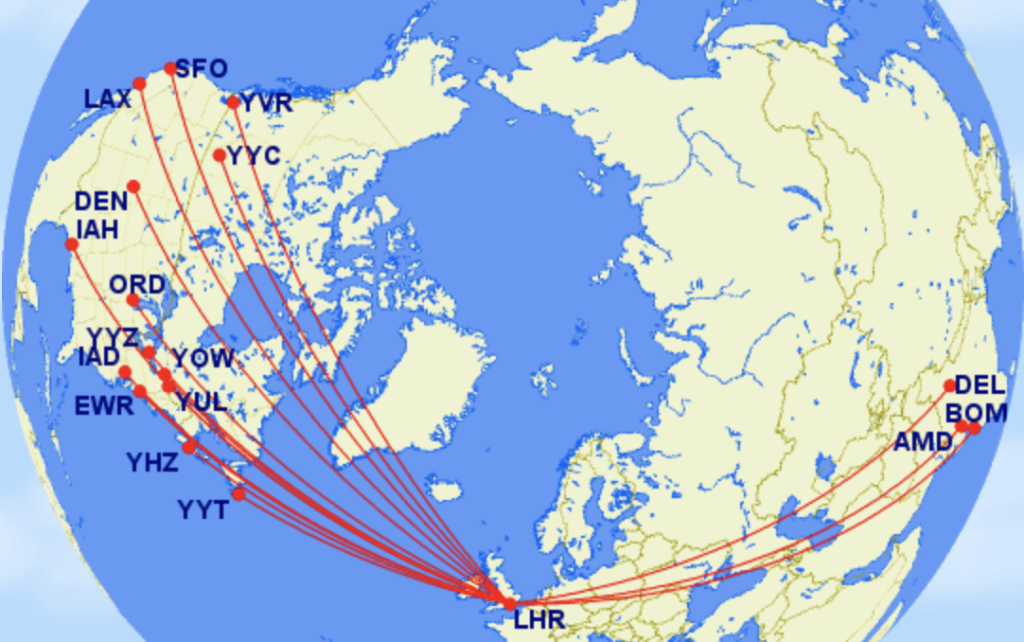

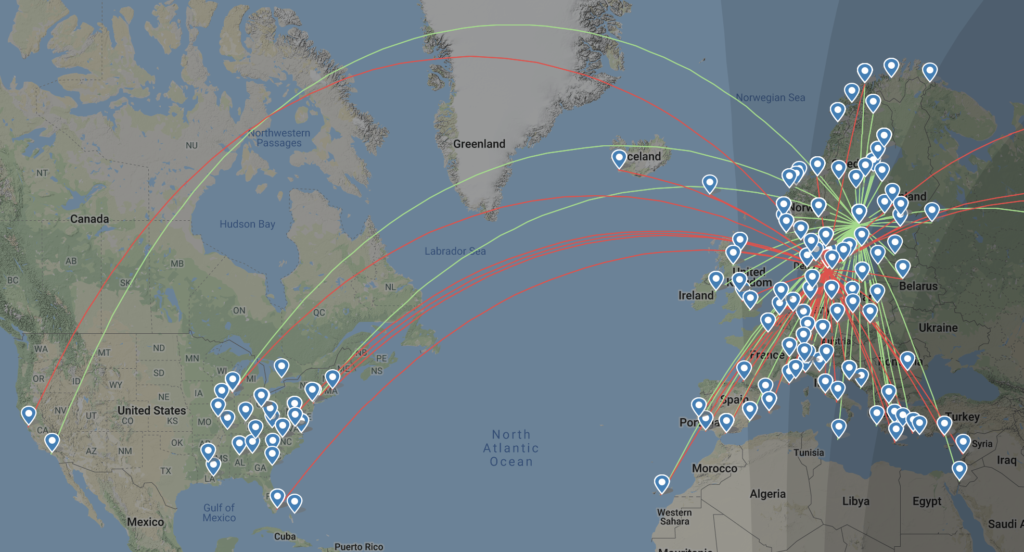

Developing London Heathrow as a hub. Air India currently operates flights to London Heathrow from Ahmedabad, Mumbai, Delhi and Newark airport. [Update, AI is discontinuing Ahmedabad – Newark in November 2018]

United Airlines operates flights to London Heathrow from Newark, Los Angeles, San Francisco, Denver, Chicago, Washington and Houston. Apart from this, Air New Zealand also operates flights to Los Angeles from London Heathrow.

But neither of them codeshare with each other even though they are members of the same alliance. Why? You gotta ask that question to the Network Planning department of the respective airlines. Air Canada operates flights from Calgary, Toronto, Vancouver, St. John’s, Halifax, Ottawa and Montreal to London Heathrow and Air India places its airline code on all of them. Then why not on United Airlines and Air New Zealand? United Airlines, Air Canada and Lufthansa have a transatlantic joint venture. Air India ever considered having a JV similar to this with United and Air Canada?

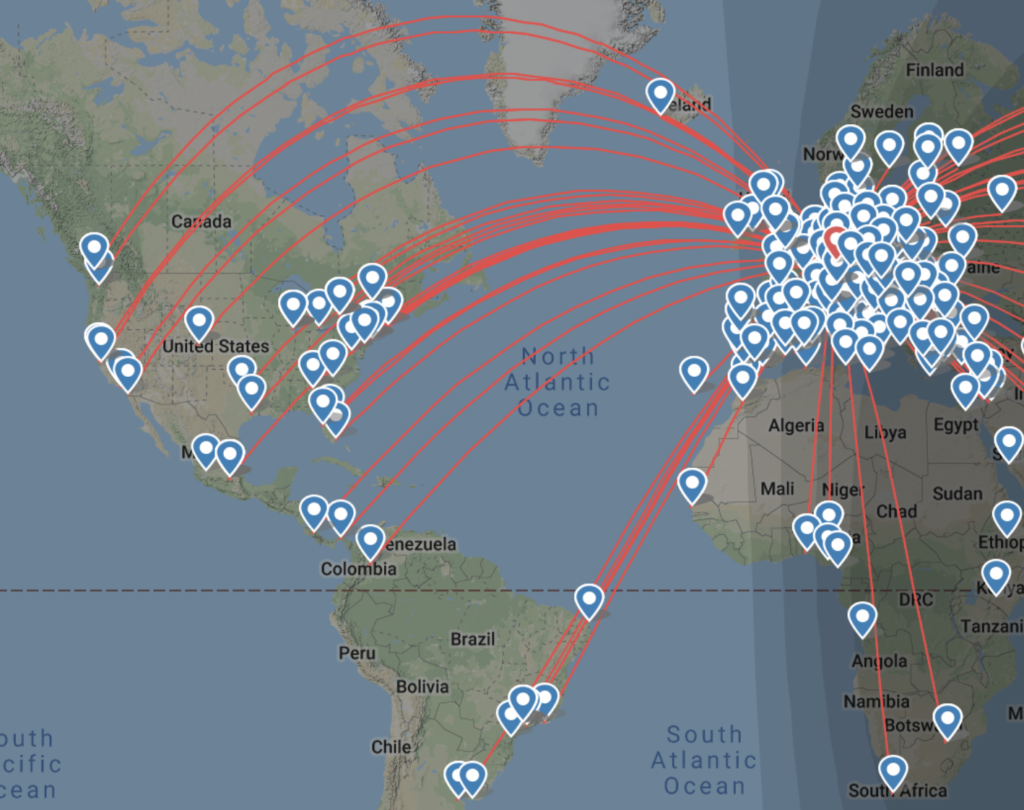

The number of options available to passengers if the Air India-United Airlines-Air Canada JV/Codeshare kicks in

On a side note, Air India is running a loss on operating London Heathrow-Newark 3x weekly service. Why not codeshare on the 12 ‘clock United Airline flight out of London Heathrow? And instead, use that aircraft and slots either to increase frequency on Ahmedabad-London Heathrow route or add flights from another destination like Amritsar, Kolkata or Kochi? [Update, Air India seems to be reading my mind. More on that soon. As we go to publication, Air India has cut out the LHR-EWR flight]

Why not other Indian cities? British Airways already operates flights to Bengaluru, Chennai and Hyderabad apart from Mumbai and Delhi. Jet Airways connects Chennai and Bengaluru to Paris and Amsterdam from where passengers can connect to North America on Air France-KLM. This leaves Kolkata, Kochi and Amritsar which have a significant demand to Europe (especially London) as well as North America. Kolkata used to have a British Airways flight to London Heathrow and Amritsar doesn’t need an introduction on its fight against Air India to improve connectivity to UK and Canada. The Kochi route is an underdog.

What could Air India learn from Jet Airways?

Jet Airways has always been the front-runner in developing connections for passengers. Now with their recent JV with Air France-KLM and possibly a future one with Virgin Atlantic and Delta airlines they would rule India to USA and India to Europe sector. Air India, look how they added flights from Chennai to Paris and Bengaluru to Amsterdam as a part of the JV. Look how they opened up the tonnes of connections for passengers from these cities. Look how they added flights to Manchester from Mumbai and opened up connections to the USA from Manchester also. It’s always about how many flight options whether one-stop or non-stop, one can offer to passengers.

Will Vistara create more problems for Air India once they go international?

Well yes. Vistara already has an interline agreement with almost all major international airlines serving New Delhi airport and it will grow stronger over time. They are already competing with Air India as well as Jet Airways for connecting passengers through New Delhi. They don’t care if the airline is oneworld or Star Alliance.

With backing from Singapore Airlines strong network and partnerships, it will start to dominate the connection market and leave Air India as a dummy even though it is a part of Star Alliance. IndiGo is trying to currently corner as many flying rights which are currently available to dampen AirAsia India and Vistara’s international growth. Air India needs to strengthen partnership with Star Alliance members before Vistara does, to be competitive in the game.

Is there a future for Air India?

Air India does not have a stated expansion plan at the moment. There aren’t any aircraft slated to be delivered after 7 Airbus A320neo. They do not have a turnaround plan or a cost-cutting plan. Neither do they have a plan for effective utilisation of available resources?

Every time a report comes out about poor utilisation of aircraft, the go-to reason is lack of spares or shortage of crew. Then a few days later, Air India would send a report regarding hiring the additional crew but do they actually go with the exact requirement?

But you got to give Air India the credit where they deserve. Air India expanded out of Delhi big time providing a lot of non-stop flights which airlines in India won’t provide in the near future. They knew they won’t be able to do this with two hubs (Mumbai and Delhi) with limited aircraft and so Mumbai was given the axe.

They could have done another thing which would have been beneficial for everyone: shifting the maintenance base to New Delhi (as it is the hub for widebody aircraft but space constraint) or Nagpur (which they tried, but failed). The main reason Mumbai airport doesn’t have a parallel runway as a part of the development after GVK took over, is Air India’s M.R.O. hangars.

To quote J.R.D. Tata, “Even if a plane is used for twenty years, it should always look as if it had come out from its factory-new, inside and outside.” And it did when J.R.D. Tata used to run Air India even under the Indian Government.

Look at the current condition of their Boeing 777 fleet and even their Boeing 787s to some extent. All airlines need a person with a sense of direction on what he wants a passenger on his/her airline to experience, one who can guide a team to effectively run an airline, one who has a set goal for his airline. Vistara has Sanjiv Kapoor, SpiceJet has Ajay Singh, Jet Airways has Naresh Goyal and IndiGo has Rahul Bhatia. When will the government hire a person who can guide Air India to the glory days?

Air India has got one of the best and most experienced crews in the world. They just need to change their attitude. J.R.D. Tata during his Air India days used to tell his staff, “Always aim at perfection only then will you achieve excellence.” And this is not only for the crew but for the entire management team.

One thing is for sure, if they go ahead with another big order for more widebodies, one would see them dominating the Indian overseas market. But they need a good management team which can help it to get back on track and is free from government intervention. The last will always remain a dream.

On a side note, how lazy is Air India? They took an entire week before they announced Mumbai-Frankfurt flights after it was bookable.

Bottomline

It’s high time Air India goes back to the drawing board. They need to start making their schedules, codeshare agreements, aircraft deployment, refurbish their aircraft with a new hard product, improve the soft product, bring back “menus” on international flights, straighten up their customer service team for timely replies and reducing waiting time on calls, social media team, fix their website to make it more user friendly and so on. Air India’s current state is due to politics whether it is at management level, government level and so-on. And this is the same for all PSUs.

Will the Government ever wake up and try to revive Air India? Or is it over for them now?

Good read. The thing is United does not want to codeshare with Air India. Right when AI became a Star Alliance member, they were able to ink a codeshare agreement with Air Canada via London Heathrow, but could not be able to do so with United. I guess United found Air India’s presence in the US to be more of a competitive threat. Hence, United recently decided to codeshare with Vistara for Indian domestic connections instead of Air India. The same case with Lufthansa.

AI should honestly switch to SkyTeam (especially since Continental left ages ago and Jet recently ceased operations) and OneWorld (lesser because nearby carriers such as MH, QR, CX, BA, UL, AA now serve South asia decently) if this is the case. Delta also shut their BOM flight recently. Though the AC agreement as well as other ones may be preventing them plus their main gateways in N. America are all UA/AC hubs too.

Very good article. First things first, AI needs clean aircrafts. I take SFO-DEL-BLR route frequently and always find seats fixed using duct tape and the seats are dirty. They don’t even have paper toilet seat covers (yuck!!!). I dread taking this flight everytime but this is the fastest option.

Yes, the only reason to take Air-India is the quickest trip!!!

I think the management knows that and they dont care about bad PR!

Just to add to what Vas is saying, Johannesburg (JNB) is a largest India-Africa market + higher yielding than Nairobi (NBO). Lagos (LOS) is a bit smaller but a better business market than NBO (lots of oil and other business traffic). NBO is served by Kenya Airways. JNB and LOS: nonstops are unavailable. Dar-es-Salaam (DAR) is also a good market and supposedly Air Tanzania will launch.

In Southeast Asia, Garuda Indonesia has launched BOM-DPS, replacing CGK-BKK-BOM-BKK-CGK. So, Denpasar Bali is now served, but Jakarta is left out. Philippine Airlines is supposedly planning DEL and BOM flights, but they seem to be delayed. If AI order the 321 neoLR this would help, range-wise, for Indonesia and the Philippines. And even parts of Mainland China!

Vietnam is different in that AI can launch flights with existing 320 equipment. Vietjet may have announced DEL but it is nowhere in sight!

Lots of silly proposals here.

First things first: STAR Alliance is a very loose marketing vehicle. Codeshares are limited and selective. Just see what LH thinks of TK!

Secondly, codeshare flights are often so expensive and restricted that they are often pointless to most travellers. Now, if the codeshare is within a JV, such as Jet has with KLM/AF/Delta, then that is another story. This is because pricing is lower and service is more seamless.

Third, there is almost NO CO-OPERATION WHATSOEVER between Air India and the STAR Alliance JV (LH+UA+AC+LX+OS+SN) through Europe. The JV is a closed partnership. AI cannot codeshare across the North Atlantic with this group because they DO NOT allow it.

The only apparent exception to this is Air Canada. However, all should note that pricing is high, and this option is quickly becoming obsolete because of all the nonstop services that have come online in recent years.

AI cooperates with Lufthansa including via codeshare through Frankfurt, so yes, one can mix and match airlines. However, the partnership is limited to Europe and Latin America. (To reiterate, LH won’t allow connectivity to Canada + USA.) The codeshare is definitely in place for DEL-FRA on AI, but it looks like BOM-FRA has not come yet. As all here know, AI is slow to act.

The idea that AI should shift everything to morning arrivals in Europe is absurd. The whole point of AI’s services is to complement existing flight schedules offering daylight departures to Europe and overnight returns back. For example, there are now nighttime, morning, and afternoon departures ex-India to FRA, and afternoon and evening departures from FRA back to India.

The idea that AI should connect all its European flights to STAR for the North Atlantic is also pointless since the STAR Alliance JV does not want AI part of their project. IT also looks like the author thinks India-Europe is a small market. Not true! It’s larger than India-USA!

Moreover, and more importantly, AI has its own portfolio of nonstops to the USA. There are interlines with many US carriers for onward connections. Why on earth should AI copy Jet Airways? Jet are stuck in the 1980s.

To address the proposals for better aircraft utilisation: AI can increase MXP and MEL by 1 or 2 frequencies each, just as they have on CPH and VIE not long ago. Both are large markets.

There is mention of NBO, but JNB and LOS are much better ideas for Africa. NBO is already served, by the way.

There is also much work to be done in Central Asia, Southeast Asia, and PR China.

It is quite embarrassing that there are just 4 or 5 nonstops to PVG to China on AI, with nothing else on offer from any other Indian carrier. The India-China market is growing fast.

Instead of more and more BKK, AI should be in Vietnam and Indonesia at least, with other countries to follow, and AI Express in Uzbekistan, Kazakhstan, and Iran (subject to sanctions difficulties.)

@Vas, I respect your views but not your name calling. Just because you know more doesn’t mean others know any less. So, off with the Silly part.

Vas,

1. Air India has codeshare agreement with Lufthansa for 17 destinations in North America, Europe and India which it serves out of Frankfurt. It doesn’t include Latin America. This is available on Air India’s website if you want to check.

2. Lufthansa group, United airlines and Air Canada JV came into effect way back in 2009 long before Air India even joined Star Alliance.

3. My idea in no way refers to Air India being a part of the JV. I have used the idea of an existing transatlantic JV for a new JV between India-North America through London. And this is only for Air India, Air Canada and United Airlines.

4. Your noncooperation of “Star JV” with Air India is a baseless argument due to reason 1.

5. Regarding your “1980s” remark, Air India won’t be copying Jet Airways strategy. It will provide options to more number of destinations through Europe that aren’t served non-stop. These one-stop opportunities will be in addition to existing non-stops. The strategy seems to be working extremely well for Jet Airways which doesn’t even provide non-stop USA flights.

6. The JV if it actually happens will also include Air India’s, United Airlines and Air Canada’s nonstop flights to and fro India and also their respective domestic flights apart from flights to London.

7. Air India and United Airlines doesn’t codeshare on United’s domestic flights even though Air India has been adding flights to United airlines hubs.

8. Same is true with Air India adding flights to other Star Alliance member hubs which I have already mentioned.

9. And to bring to your knowledge. Interline agreement<Codeshare<JV.

10. Regarding shifting Air India’s existing Europe flight to morning arrival, let me explain you why. Now as a tourist or a business men would you waste an entire day in travelling by arriving in the evening or would you rather catch a morning arrival flight? If you wanna connect through Air India’s evening flight then you would reach your destination at night. And as an airline would you be better off by providing more connection opportunities out of the airports that you serve than arriving at a time when there are less options available? Air India can tap into SAS and Lufthansa’s vast network (Europe, North America and Latin America) only if they have a morning arrival. That is a fact which no one can change. Jet Airways, KLM and Air France timings match with each other and they are reaping benefits. You singled out Frankfurt case. It is the only route where both Air India and a European Star Alliance member airline are operating flight on the same route.

11. London flights are perfectly timed for connections, all it needs is to put pen to the paper to sign a JV.

12. Codeshare and JV would help Air India to improve its load factor on its European flights as passengers could connect to more destinations in Europe as well as to North America and South America.

13. Regarding Star Alliance member history, United airlines and Singapore airlines have had issues in the past but they went on to co-operate by forming a JV as it was best for them. Similarly Lufthansa and Singapore Airlines. Air India is a case of laziness, lack of insight and research from management team’s part.

14. Air India tweeted a year back they would be adding flights to Nairobi hence the mention. Should have clicked on the link and read it.

Good Points Raised both @Vas & @Karan

Karan,

I appreciate your response but you are still not following the crux of the matter: that the STAR Alliance JV does not include AI -operated flights between India and Europe and does not want to codeshare with AI operated flights between India and Europe to connect with USA/Canada flights. Air Canada is an exception via LHR, and their cooperation with AI probably dates back to pre-STAR Alliance days.

This is the subset of flights that are in question: AI-operated flights. Not LH/LX flights between India and Europe. (SN are soon gone.) Yes, AI codeshares on flights operated by LH on this sector, and surely on many others, but LH codeshares on AI flights to Frankfurt strictly for connections within Europe or to South America. Again, this is about LH codesharing on AI metal. UA does not codeshare on AI-operated flights to FRA or LHR or anywhere else in Europe either, because they don’t want to. Air Canada does do only via LHR.

Why is this so? Their JV is exclusive and they don’t want AI to be part of it.

(The opposite is true with Jet regarding KL/AF/DL through AMS/CDG. They also have a separate agreement with VS/DL through LHR.)

The STAR TATL JV simply does not NEED AI because they have their own services to India, nonstop from USA, Canada, and Europe. The STAR TATL JV does not WANT AI because USA/Canada-Europe is a highly lucrative market itself. They don’t want to dilute yields by dumping too many India passengers into the mix.

Just to explain, airfares between the US and India run low, across cabins. These fares are always lower than US-Europe fares when you divide by distance. Often, during the summer, the airfares are lower even WITHOUT dividing by distance. So, for example, why should UA want India pax connecting on their lucrative LHR and other European services? Sure, you can buy an interline ticket involving AI to LHR followed by UA, but the fares are typically kept high to discourage people from doing this. Does this make sense?

Jet’s relationship with Skyteam is different because KLM and AF were historically very weak in the India market. Basically, DL/AF/KL wanted a cheap way into India and let 9W do most of the work. There are no DL nonstops either (not yet).

LH, AC, and UA all take different approaches to codesharing and interlining with AI. But none of them want to do what you want them to do, which is to codeshare in all cases and sectors. You cannot blame AI for this state of affairs.

LH/UA/AC interests are different than your interests or AI’s interests. AI flies to cities that happen to be strong UA hubs because they are strong natural markets, not because of UA. Austrian and Lufthansa are happy to offer European connectivity to AI. AC is happy to work with AI through LHR, DXB, BOM, and DEL. But there are limits to their cooperation.

I know the differences between interlines, codeshares, and JVs. In fact, various JVs come in their own flavours. Some are deeper than others.

Regarding AM arrivals into Europe, well even I was sceptical at first when AI put together its Euro network. But it seems to be working. Remember, the main aim is to connect Europe with the Indian domestic market along with a bit of Southeast Asia on the side. Maybe Nepal and Sri Lanka too.

The other thing to consider is that AI’s schedule allows one to work all day in Europe before flying back. This is the opposite of what Euro carriers typically offer to India. If AI’s plan was not working we would know by now.

SQ and UA have no JV whatsoever. They began a limited and selective codeshare for regional connectivity (such as SIN-CGK or SFO-LAS). But on the core nonstops from between Singapore and USA, they compete vigorously.

Regarding Nairobi, yes I am aware of their various announcements. However I am simply pointing out, via my friends in the airline industry, that other African markets are unserved from India and more promising.

To end, I’ll state that there is no chance in hell that AC and UA are willing to form a JV with AI via LHR. LHR is too lucrative for them!

You are getting this in the wrong way. I have stated it before and I am repeating it again. You are mixing things up. I put forward an idea of a JV for India to North America through London. I made myself very clear that I am taking the transatlantic JV as an example. Both the JV are completely different in their target market. Hence cannot merge one with another and no one asked for it happen also and neither Air India being a part of the JV. You should have given more thought what the article is portraying in the first place.

Lufthansa group, United airlines and Air Canada’s JV is only for transatlantic flights. It doesn’t include flights to India or any other region.

This brings me to another point that, Lufthansa and Air India codeshare agreement covers flights to Amsterdam, Berlin, Bengaluru, Chennai, Chicago, Copenhagen, Delhi, Denver, Detroit, Düsseldorf, Los Angeles, Mumbai, Munich, Oslo, Stockholm, Stuttgart and Washington our of Frankfurt. Now point me to the South American destinations that you were talking about? Should have checked Air India’s codeshare website as I asked you to do initially.

Air Canada and Air India signed a codeshare agreement in 2014 after Air India joined Star Alliance and not before. The codeshare includes flights out of London as I have mentioned apart from Air Canada’s flight to Hong Kong, Paris, Milan, Shanghai and Tokyo.

Both the above point prove that both Lufthansa and Air Canada are having a partnership with Air India through Europe for passengers to North America. Again do not confuse it with Air India being a part of the transatlantic JV. So it is only a weak link with United Airlines. And this is the same for United Airlines domestic network also where both Air India and United Airlines do not co-operate.

The reason why interline tickets are expensive is because they do not include saver fare and in most cases it is flexi tickets. It is like buying two separate tickets with just the convenience of through check-in and baggage transfer. And that is why United’s interline tickets are expensive. This true for all interline agreements across the world.

This bring me to the point that LHR market is lucrative for United. It is lucrative for all airlines whether Air India, Delta or any other airline. And as you mentioned Delta and Virgin Atlantic have a partnership with Jet airways through LHR and it would grow stronger in the coming time. Air India, United and Air Canada can do the same. Air India and Air Canada is already doing it, United will be an addition to it.

And as for your input on pricing from London, one can get a round trip basic economy ticket to LAX from LHR on United for INR 30k. Wanna add a check in bag pay INR 8k more. This is a 11hr flight mind you.

As for Newark-LHR route, it operated by 767s and 757 so much so for a premium route. The 12 ‘clock flight out of LHR which will be the main flight in codeshare is operated by a 757. And it can be up gauged with Newark being the base for 787-10. That’s a totally different topic.

And regarding Singapore Airlines- United Airlines JV, it is a codeshare agreement covering United’s domestic flights out of Houston only for time being. But in their DoT filing they have applied for a two way codeshare which can cover all nonstop flights and connecting flights from USA and Singapore. It will happen sometime in the future,can’t comment on the time frame though.

All in all, I haven’t shared the Idea of Air India joining the transatlantic JV. I merely shared 3 ideas 1) AI, AC and UA JV out of LHR 2) Enhancing Codeshare with Lufthansa apart from what is already there 3) Enhancing codeshare with SAS apart from other suggestions. And to make it clear these aren’t my intentions. I am only pointing out an opportunity which exists.

In addition to Vas’s points above, also keep in mind that AI is a state-owned carrier. How many state-owned carriers do you see UA/AC/LH allowing into their JVs? None right! That’s because they don’t have the same standards (missed connections frequently, delays, worse product, bad service, mileage program sucks). They seem more keen towards Vistara all because they are a privatized carrier. AI is not the only state-owned carrier not being in the JV but TG, EgyptAir, Ethiopian, Air China to a lesser extent. Just look at how AI got rejected from joining Star Alliance in 2011.

Nice article after a long time . Thanks.

Air India can certainly look into utilizing the fleet by adding some interesting and demanding routes.

For e.g.

1. Mumbai to Melbourne / Sydney on its 787

2. Mumbai to Nairobi / Dar as salaam on a321 or 787

3. Kolkata to LHR on 787

4. Mumbai to LAX on 777 3 weekly

Etc.

London LHR : slots are the biggest stumbling block. As a matter of fact for many airlines. British Airways are the kings of LHR. So Kolkota-London LHR is a bit difficult. But Gatwick and Stansted are options

Enjoyed this article, I can imagine how many hours one needs to put in researching this, great job !

Well, Air India is starting Flights from BLR to LHR using a 787. So the utilisation will go up there. They are also gonna launch BLR BKK with an A321. So looks like they are trying to utilize the aircraft better than earlier.