Jet Airways, an airline celebrating its 25th year of operations, posted a huge loss, for the second consecutive quarter this year. They declared the results last week. Here are the highlights,

- Total revenue up at INR 6,363 crores

- Operating costs of INR 7,697 crores

- A net loss of INR 1,261 crores

- Passengers carried increased to 7.45 million

- Non-fuel CASK maintained at almost the same level as one year back

Operational Analysis

The table will give you a rough idea of what the operations looked like in the past quarter. Fleet size increased over the quarter, but ASKMs (Available Seat Kilometre) remained the same and departures on the other hand decreased. Contrasting right? This was because of average aircraft utilisation, the time an aircraft flew, dropped in the past quarter. This change reflects a decrease in efficiency regarding available resources.

But it helped Jet Airways increase On-Time Performance to 84% which was an area where Jet Airways was scrutinised the most in previous quarters. If you remember, Jet Airways tried to improve their aircraft utilisation by adding additional flights and reducing layover time. This affected their performance as many Jet Airways flights started reporting delays. The thinking wasn’t at fault but like in all cases execution didn’t happen according to the plan. Jet Airways tried to maximise their resources to increase efficiency, but instead, it threw their schedule out of order.

Jet Airways has managed to decrease their CASK (Cost per Available Seat Kilometre) minus fuel expense and forex by 4.2% to INR 2.94. But this decrease was offset by an increase in fuel costs and forex. Jet Airways had a forex loss stood at INR 772 crores for H1 FY19.

RASK stood at INR 4.06. RASK stands for Revenue per Available Seat Kilometre. It is is a combination of yield and passenger load factor. Average fare per passenger was INR 7202. This is, in fact, low as it is an average of international and domestic fares.

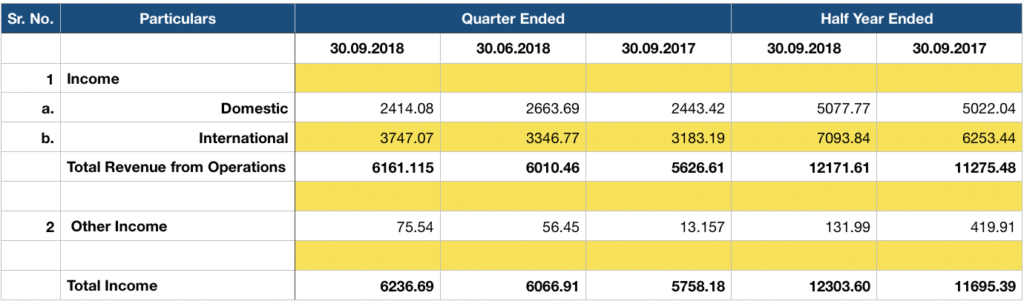

Revenue Analysis

Jet Airways managed to increase revenue in two categories:

- Cargo revenue went up by 13.7% to 514 cr over the same time last year

- Revenue from codeshare and interline partners increased by 30.9% compared to the same time the previous year, on back of traffic which has gone up by 8.6%.

Jet Airways codeshares with around 20 airlines. They have opened up a range of new connection possibilities to Australia, Indonesia, Vietnam and beyond through Singapore, Bangkok and Hong Kong.

Jet Airways has found a new hub in Singapore with 3x daily flights from Mumbai, 3x Daily flights from New Delhi, 2x Daily flights from Bengaluru and now daily flights from Pune also. A new codeshare agreement with Hong Kong Airlines on Hong Kong to Los Angeles route will supplement this moving forward. This is one of the areas where Air India needs to learn from Jet Airways. A stronger codeshare agreement will help an airline increase revenue and traffic.

Revenue from operations includes a one-time payment of INR 111.42 crores. This payment is a refund of rental paid earlier for several Boeing 737NG aircraft inducted in the fleet but wasn’t covered under Power by the Hour maintenance at that point of time. So if you subtract that, Jet Airways revenue has stayed almost the same over the quarter at INR 6049.69 crores.

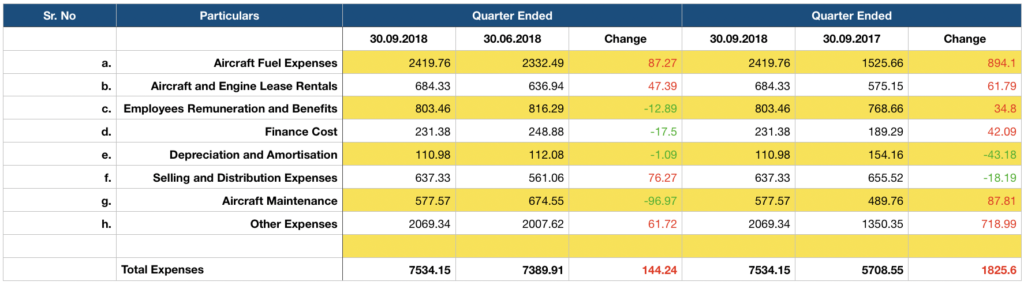

Expense Analysis

Jet Airways’ expenses have increased, but at least some areas have seen a decline in comparison to the previous quarter. Their net loss stood at INR 7534.15 crores against revenue of INR 6236.69 crores.

The coming quarter may see a marginal decrease in expenses.

- In the coming quarter, Aircraft Fuel Expense would remain almost flat. The reason being, Jet Airways ASKMs would stay constant over the period due to route rationalisation. Since another three fuel-efficient Boeing 737 Max aircraft will join the fleet this quarter, there may be a marginal decrease in the fuel expenses. Fuel prices are already lower in comparison to the last quarter.

- Aircraft lease is affected by forex prices. Since the rent is in US dollars, a stronger rupee will only help them. And it will rise as Jet Airways is planning to undergo a sale and leaseback of 6 of their Boeing 777-300ER aircraft.

- Employee remuneration and benefits are sort of a tough one to crack. Senior level management employees took a 15% pay cut to help with immediate cash flow. Jet Airways haven’t paid 15% of their employees promptly. So whether the reduction accounts for that or not is ambiguous. Employee layoff is the only way that aspect of expense can be reduced/controlled.

- Aircraft Maintenance will further reduce this quarter. The single main reason being the grounding of aircraft. Jet Airways has grounded 1 Airbus A333 and 1 Boeing 777-300ER at Chennai Airport. Another Airbus A332 is out of service at Mumbai Airport.

- If Jet Airways manages to reduce Finance, selling & distribution again, and Depreciation & amortisation costs, they might be able to achieve their target. This will help offset any fluctuation in forex.

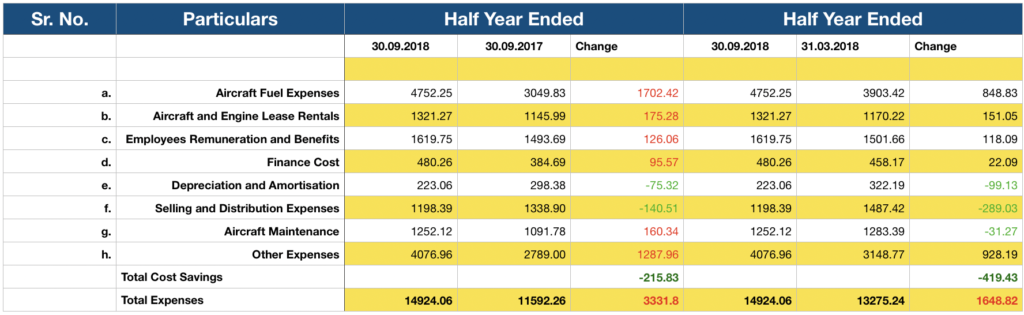

Is the turnaround plan effective?

Well almost, if you compare H1FY19 to H2FY18, Jet Airways has seen a cost savings of INR 419.43 crores but not over INR 500 crores as specified. The cost savings were however offset majorly by forex fluctuations. The reason being debt and expense is dollar-dominated.

Debt

Jet Airways has a gross debt of INR 8,411 crores. Of this, aircraft debt stands at INR 1,851 crores. Jet Airways wants to sell and leaseback 6 of their Boeing 777-300ER aircraft to pay off the entire aircraft-related debt. This directly translates to an asking rate of INR 308.5 crores for each Boeing 777-300ER. The average fleet age for Boeing 777-300ER is 11.6 years.

Jet Airways has been regularly paying dues but one of the things that concern is the repayment of principal non-convertible debentures on September 28, 2020. I know it is still around two years away, but it is a massive figure of INR 747.89 crores.

Fleet

Jet Airways has a fleet of 124 aircraft according to their website. They currently own 16 aircraft out of which 10 are Boeing 777-300ER, and rest are Boeing 737s.

Jet Airways has repeatedly pointed out that that they will engage in sub-fleet simplification. To point out, Jet Airways fleet includes

- ATR 72-500 V1: 66 Economy (Y) seats (Based at Bengaluru)

- ATR 72-500 V2: 72 Y seats (Based at Delhi and Indore)

- Boeing 737-700: 8 Business (J) + 126 Y seats

- Boeing 737-800: 12 J + 156 Y seats

- Boeing 737 Max 8 V1: 12 J + 156 Y seats

- Boeing 737 Max 8 V2: 12 J + 162 Y seats

- Boeing 737-900: 28 J + 138 Y seats

- Boeing 737-900ER: 12 J + 172 Y seats

- Boeing 777-300ER: 8 F + 30 J + 308 Y seats

- Airbus A330-200: 18 J + 236 Y seats

- Airbus A333-300: 34 J + 259 Y seats

That is 11 types of sub fleet across four types of aircraft family in a fleet of 124 aircraft. Having so many sub fleet increases operational costs. There is no word on when will Jet Airways go ahead with the refurbishment of their Boeing 777-300ER aircraft to a 2-class version doing away with first class. Also no word on the delivery of their outstanding order for 10 Boeing 787-9. The order still reflects in Boeing’s order book, but no one knows when it will be considered for delivery.

What about the much talked about ATR deal and network?

There were two ways of going about this. Jet Airways could wet-lease a part of their ATR fleet, supposedly to TrueJet. The deal would have included the 6-7 66 seat ATR 72-500 stationed at Bengaluru Airport. Another was to retire the ATR fleet completely.

Jet currently has 15 ATR 72-500 and 3 ATR 72-600 in its fleet. Now from the data I pulled out, 3 ATR72-600 aircraft haven’t flown for quite some time now.

- VT-JCX: Last flight Jaipur-New Delhi on May 16, 2018

- VT-JCY: Last flight Dehradun-New Delhi on June 29, 2018

- VT-JCZ: Last flight Mumbai-New Delhi on June 16, 2018

- VT-JDD: Last flight Chennai-Mumbai on October 2, 2018.

If Jet Airways eventually goes ahead with gradual ATR retirement, expect to see a lot of routes going under the axe. South Indian routes will go first. 7 ATR 72-500 (72 seats) are stationed at Indore and New Delhi. The only ATR frequency on Indore – New Delhi route is facing the cut in route consolidation.

So what the does the future look like?

It is out in the open that Tata’s are interested in acquiring Jet Airways. Why wouldn’t they be? Jet Airways has a large pool of highly trained and excellent employees, aircraft, slots and most importantly a strong, loyal customer base. While Vistara is slowly gaining momentum, availability of slots is a huge problem. They haven’t been able to infiltrate Mumbai which is a Jet Airways fortress properly. Neither has AirAsia India.

If Tata’s do take over, what would be interesting to see is if they continue with the Jet Airways brand or absorb it under Vistara. We all know mergers in Indian aviation haven’t gone well, maybe this one will break the jink.

Keeping the Tata angle aside, Jet Airways is actively trying to turn it’s ship around. They have succeeded in some aspects of cost savings, but as mentioned, circumstances haven’t supported Indian airlines this time. Crude oil and foreign exchange prices played spoilsport for the entire aviation industry.

Airlines in India haven’t been able to increase their revenue, because they haven’t been able to raise ticket prices. Airlines in India cannot completely pass on the increase in costs to passengers. The reason being a significant part of the growth in Indian aviation is being seen in Tier 2/3 cities, which are price sensitive. If you increase the cost of the ticket, there would be a reduction in passenger loads because people would switch back to trains. This would have a negative impact on growth.

Jet Airways is desperately trying to raise cash by selling their stake in JetPrivilege, which is one of their last remaining assets apart from the 16 aircraft they own. So even if Jet Airways managed to fly out of the headwinds and manage to turnaround like SpiceJet, the question still remains,

Whether Jet Airways will succeed in the long run or not?

Great analysis Karan ! Bravo

Im hoping you get time to do a comparative analysis with say Indigo and Jet (because the data is public, unlike Vistara). It would be great to see what they are doing right and where they lag compared to the industry

@Jude, IndiGo does not make money on their flights, but more on Sale and Lease Backs. That is a gut feeling first reaction from me.