One of my most favourite ways to earn miles in the whole wide world is the HDFC Bank 10X offer. I can’t say enough about how this is my favourite promotion, and I keep coming back for me. HDFC Bank had put out 10X Rewards for International Spends earlier this year as well, which meant on all your non-INR spends, you could practically get up to 33% back as reward points (33% for the HDFC Bank Diners Club Black card, lower for other Diners Club cards).

In the last “renewal” of this promotion, HDFC Bank changed the T&C a slight bit to remind us that only swipes (physical transactions) would count for 10X going forward, and not online purchases. The other thing that I’ve had to deal with over the past few months has been the total non-acceptance of Diners Club in certain countries. There, I would resort to the use of my Prestige card which is a Visa Credit Card, but imagine the number of miles I was leaving behind.

So, this month, I started looking around about my options and turned up with a wonderful one, or so I think, even though it is a short-lived one for the moment.

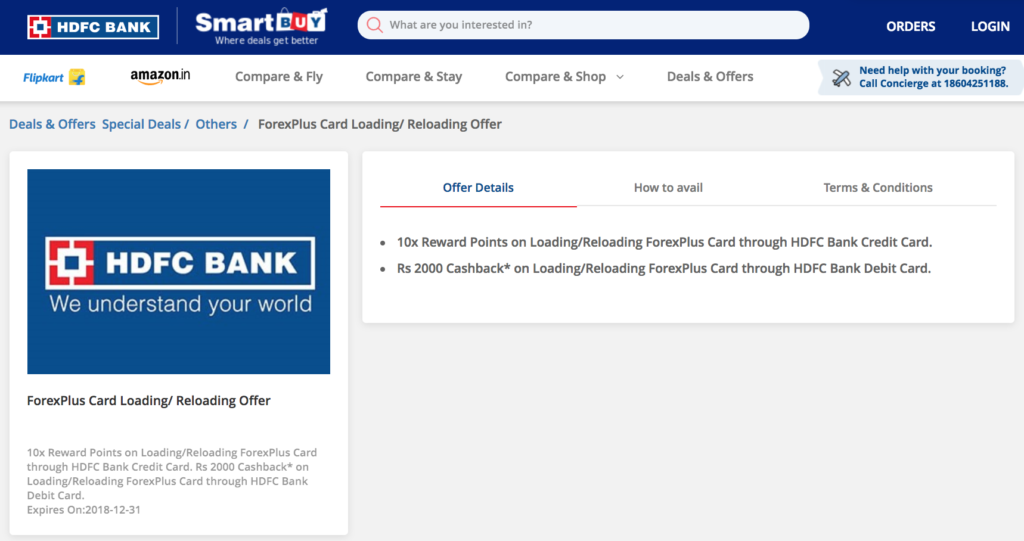

It turns out, HDFC Bank is offering 10X Rewards through December 31, 2018, to those who would reload their HDFC Bank Forex prepaid cards with their HDFC Bank Credit Cards.

Here are the T&C:

- The offer is valid till 31st December 2018.

- A customer would be eligible for either debit or credit card offer.

- The offer is applicable only if Forex Card is loaded through SmartForex Portal

- Customer if communicated by HDFC Bank Ltd. Shall be eligible for 10X Reward points on loading/reloading ForexPlus Card online with HDFC Bank Credit card.

- Customer will be eligible to earn a maximum of 5,000 reward points per customer per month for the Credit card offer

- Credit card offer is valid only on credit cards with Rewards points feature (Not valid on Jet Cards, Value plus and other cards which don’t have reward points).

- The Reward points will be posted within 90 days from the month of transaction.

So, I went about ordering myself a new HDFC Bank Forex Plus card, which cost me INR 500 + GST but is valid for 5 years now. As an Imperia customer, I will get it at 50% off though I will have to chase the RM for “doing the needful.”

The card can hold 22 different kinds of currencies, including:

- US Dollar (USD)

- Euro (EUR)

- Swiss Franc (CHF)

- British Pound (GBP)

- Canadian Dollar (CAD)

- Australian Dollar (AUD)

- Japanese Yen (JPY)

- Singapore Dollar (SGD)

- UAE Dhiram (AED)

- Swedish Krona (SEK)

- Hong Kong Dollar (HKD)

- Thailand Baht (THB)

- South African Rand (ZAR)

- New Zealand Dollar (NZD)

- Omani Riyal (OMR)

- Danish Krone (DKK)

- Norwegian Krone (NOK)

- Saudi Riyal (SAR)

- Korean Won (KRW)

- Bahrain Dinar (BHD)

- Qatari Riyal (QAR)

- Kuwait Dinar (KWD)

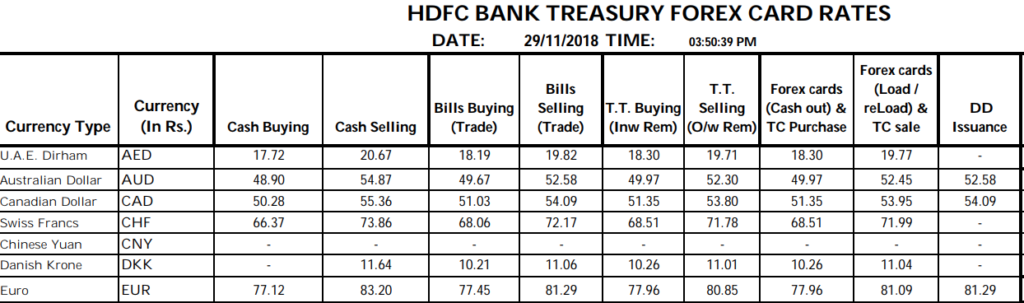

I went for a name-engraved card which took for a week to arrive at my nearest branch, but I just picked it up yesterday. I looked up the rates, and they were not the finest in the industry. For instance, here is the forex price from HDFC Bank’s treasure yesterday. You would see, HDFC Bank asks me for INR 81.09 per Euro I’d like to buy.

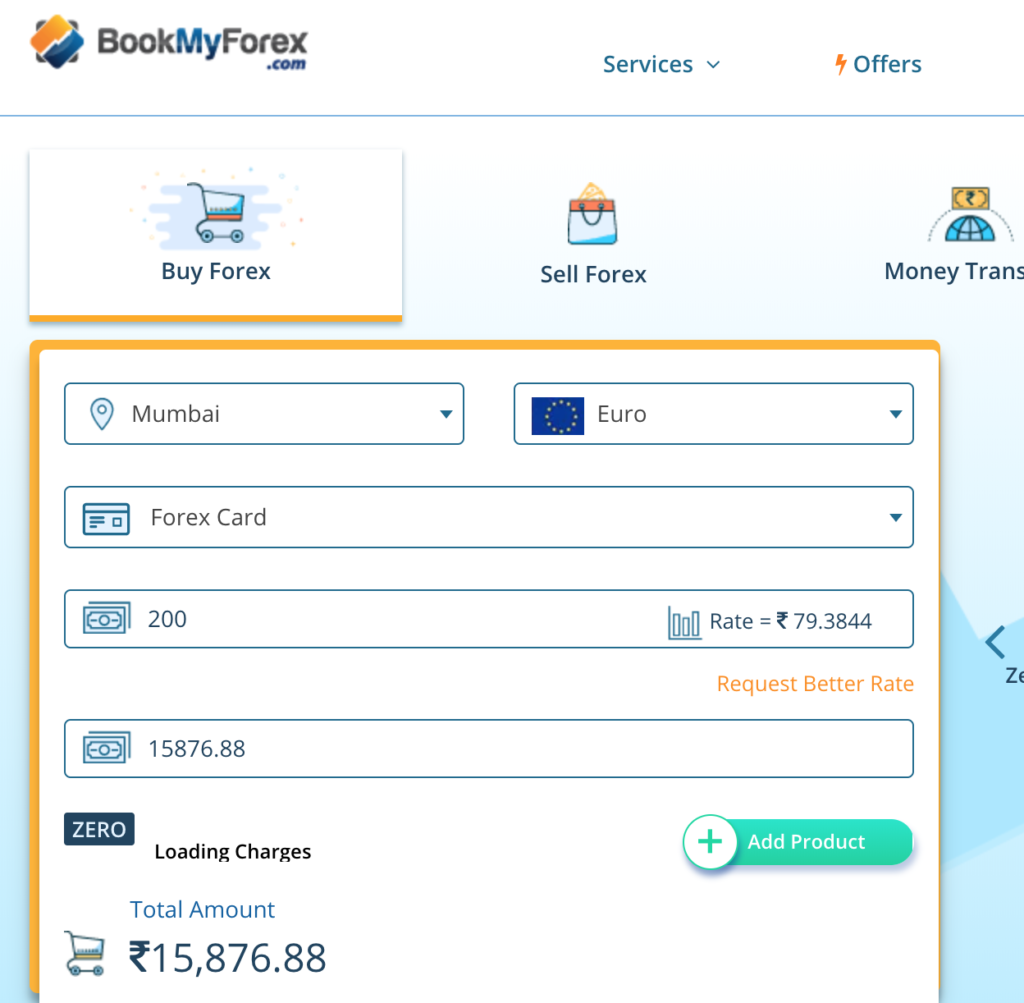

On the other hand, this is BookMyForex pricing, selling at INR 79.39 for the same Euros. I have to admit; they have the finest rates I’ve used — additionally, no charges to load or reload.

But, for a large extent, the 33% rewards on Reloading using the Credit Card is a great offer. So, I think I’d be willing to pay a couple of rupees extra for those rewards in exchange for a 33% return. I’m still to load up, but I computed, and I could get 33% rewards for the first INR 16,666 I spent every month loading up on Forex, given the 10X rewards are capped at 5,000 Reward points.

There are two reasons to do this for me. First, 33% rewards on the Diners Club Black would mean I would be able to get another 5,000 Miles for money I would anyways spend. Second, I avoid the embarrassment of being refused the use of a Diners Club card at many locations. Prestige is 8 Miles/INR 100, but this is 33 Miles/INR 100, and that is a huge difference.

What do you think of my grand scheme of things? Anything I need to watch out for? Any of you have done this before?

The offer is extended (Expires On:2019-09-30) but now says $1K mininum for 5000 maximum points. am I reading this right that even when you load INR 70000 now with the new T&C, you can get a max of 5000 points. which is around 7% as bonus. Is it a type error by HDFC on either minimum loading of $1000 or maximum bonus rewards of 5000.

Offer: Get 10X Reward Points on loading $1000 or more with HDFC Bank Credit Card

T&C: Customer if communicated by HDFC Bank Ltd. shall be eligible for 10X Reward points on loading $1000 or more with HDFC Bank Credit Card.

Customer will be eligible to earn a maximum of 5000 reward points per card per month for Credit card offer.

This offer has been extended till 30th Sep 2019.

Please before blindly loading your forex card, kindly read the TnC. This is a trageted offer only for those customers who have received such intimation from HDFC.

“Customer if communicated by HDFC Bank Ltd. Shall be eligible for 10X Reward points on loading/reloading ForexPlus Card online with HDFC Bank Credit card.”

Would be great if Ajay could update the article, as currently it is misleading the customers.

@Aman, even I did not get any email and you are under no compulsion to load the card. This is my interpretation and other people who did not get the email are getting the points. So what is the problem again?

Does anyone know if there is a stipulation on when the funds loaded on the forex card needs to be used by? Assume the December 31 cut-off is for the loading of the cards?

@L_D_M don’t think there is any expiry with that money. Loading offer is only till end of the next month though.

Thanks. And is the 5000 points bonus per calendar month or statement month, do you know. As ever, HDFC’s T&C’s are ambiguous.

Calendar Month.

This offer is valid only till this month end and cap of 5k. Any idea if it will be extended like dinners 10x offer?

@Hrishig, you are just consumed by Greed at the Moment 🙂 We don’t know yet. Let’s see.

Most of the time there used to be 5x promotion for Forex load using HDFC credit cards in the Forex Card Account load page. You should check out that often.

Hi Ajay,

This seems to be “by invitation” as per T&C.

Unfortunately, I haven’t received any email from HDFC yet.

Regards,

Sandeep

@Sandeep, no, this is an open from all as per what I heard. Else you won’t have seen the T&C so openly.

@Ajay in the T&C its clearly written

“Customer if communicated by HDFC Bank Ltd. shall be eligible for 10X Reward points on loading/reloading ForexPlus Card online with HDFC Bank Credit card.”

Hi Ajay,

Don’t you think that one should go for ‘HDFC Regalia Forex Plus Card’

You load a single currency i.e. USD and then you can use it for payment in any currency without cross currency conversion charges. Plus no cash withdrawal charges from select ATM.

@Amit, Maybe you are right. Maybe I did not see the fine print given I got what I needed. Another time.

Hi Amit,

thanks to your recommendation I got myself the HDFC ForexPlus Mastercard variant last saturday for an upcoming trip. But when I asked if there is a list of banks on whose ATM, there are no withdrawal charges, the executive drew a blank face and told me it should be on the website. I couldn’t find any list on their forex website. Do you by any chance know of such a list country wise? Or does it work on any bank ATM without any charge?

Thanks,

Tanmay.

Hi Ajay,

Just few queries as till date have never used Forex cards.

Assuming I get a forex card loaded on bookmyforex, will there be any transaction charges when I swipe that internationally?

Also, assuming I loaded 1000 USD and want to convert some or all of them later to dirham, any provision for that and any charges?

Because the forex card rates are definitely much cheaper than rates at which I buy dollars.

1) No additional charges for swiping if you are paying in the same currency as on your forex card but ATM withdrawal in US you have to pay anything between $1.5 to $5 per withdrawal depending on bank. this is same if you withdraw from you Debit Card or Forex. But if you use debit card then over the above charge you will be paying Currency conversion+GST.

2) If you withdraw Dirham using you USD loaded card. Currency conversion+GST will apply. You can load the same card with multiple currencies eg USD & Dirham. then there will be no additional charges.

Priyansh, as far as I know, Bookmyforex only deals with Axis Bank forex card, and they do not support HDFC Bank forex card loading and reloading. This is as per my conversation with their customer care few days back.