Citibank launched its premium lifestyle credit card, Citi Prestige 5 years ago in India. While Ajay applied for the card immediately and wrote about it, I was on the fence until I was convinced about the benefits. Having said that, in 2015, I finally took the card and have consistently used this card for 4 years now.

The annual fee for the card, INR 20,000 + taxes is not small by Indian standards. So, this year before renewing the card, I decided to pen down all the benefits I reaped in 2018. I thought it would make for an interesting read.

Renewal Bonus: Prestige comes with a pretty good bonus on sign-up and renewal. I got 2,500 points do not expire ever and I can convert them to 10,000 airmiles across 14 airlines. Additionally, I also got INR 10,000 worth of gift vouchers from Taj Hotels. I used the voucher to partly offset our stay at the Taj Falaknuma Palace last year.

The Taj Falaknuma Palace, Hyderabad

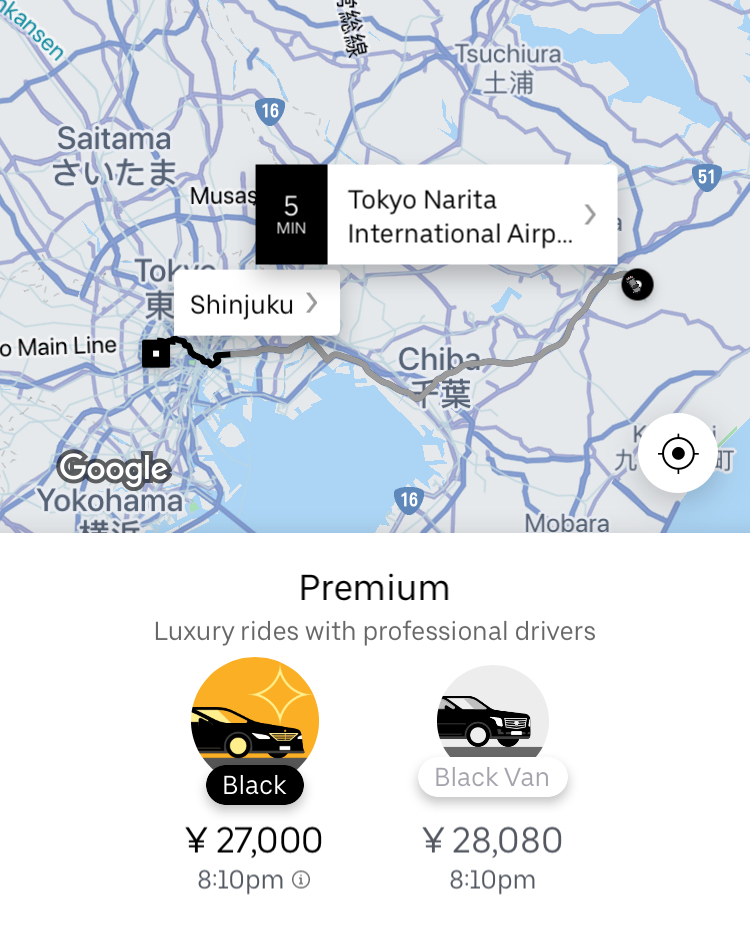

Complimentary Meet & Greet and Airport Transfer Service: Every calendar year I get 2 complimentary airports meet & greet services and luxury car transfers (one-way) to and from the airport. While I didn’t get much value from my meet and greet service in Tokyo Narita, I used both my car transfers on international work trips last year. One of these two transfers was from Narita airport to my hotel in Shinjuku, Tokyo. It was my first trip to Japan and where I landed late evening in Narita. Had I hailed an Uber I would have spent a minimum of JPY 27,000/ ~INR 17,000.

I used the second airport transfer service in Hong Kong on another work trip. I had arrived on Jet Airways’ morning flight to Hong Kong, and had to rush to a meeting straight from the airport. Not only did I get a comfortable ride to the city in a Mercedes but also I saved up another HKD 1000/ INR 9,500 had I hired the same car using Blacklane. All in all, just using the 2 airport transfer benefits offset the annual fee I paid for the card.

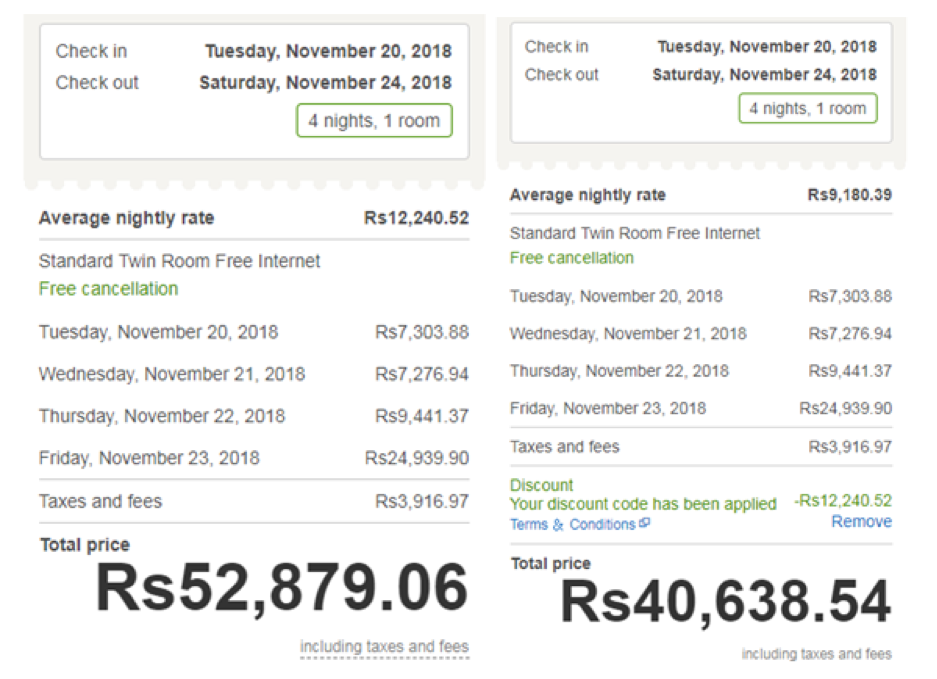

4th Night Free on Hotels: In 4 years of holding this card, I’ve hardly used the 4th-night free benefit where booking 4 consecutive nights gets the cardholder one night free. However, I used it last year during my trip to Tokyo. The self-serve booking portal works seamlessly and all I had to do was plug in the coupon code and then punch in my card number. It immediately discounted the stay bill by INR 12,000, i.e. 25%.

Unlimited Priority Pass Lounge Access: This by far is my favourite benefit on the Citi Prestige Credit Card. Last year was fairly busy, with international work travel and there were days when the only meals I ate were at the lounge. I used my Priority Pass more times than I can remember. In Hong Kong alone, I visited the Plaza Premium First and the regular Plaza Premium Lounge 5 times. Some other lounges that made my travels comfortable were The Haven Arrivals lounge at Changi and the massive SkyTeam lounge at London Heathrow.

Amongst the domestic lounges, ever since Jet Airways stopped lounge access to Jet Privilege Platinum members, my Priority Pass has come in handy, to access both the GVK Lounge and the Travel Club Lounge at Mumbai Airport. Without the Priority Pass, access to these lounges comes at a price. For all the times that I have waited comfortably in the lounges last year, I gained a value of a minimum of INR 38,000.

Mumbai Terminal 2 GVK Lounge

Overseas Medical Insurance: This is a benefit that is often overlooked. Each year, Citi issues a complimentary overseas medical insurance policy worth USD 50,000. This is applicable on all international travel for trips up to 30 days. A valid insurance cover is also mandatory to submit while applying for visas to many countries. And while it’s not expensive to purchase insurance online, having insurance already taken care of, just makes life hassle-free.

If I just add up the value I have reaped from these 5 benefits, I’ve gained value of over INR 100,000 last year. That’s 5 times the value of the fee I paid for this card. Needless to say, that point earning ratio on domestic and international spends is great and Prestige points do not expire. Additionally, unlike many other cards that don’t give points for utilities, insurance, fuel, etc., this is one card that I can use without thinking anywhere and everywhere for all spends big and small.

What has been your favourite hack of the Citi Prestige Credit Card?

Hi ,

I have 4000 points , how can be they used for maximum benefit.

Thanks

Deep

Hi,

Thanks for the great review, any idea about the citigold services? How are their wealth advisory services?

Regards

Can I get Citi Prestige as LTF, currently I hold HDFC Infinia (LTF), HDFC Diners Club Black (LTF), ICICI Emeralde and ICICI Diamant.

@shiv for once, pay for a card please. Also, no, you can’t get it life time free.

If you hold Citi Gold Private Client level relationship (which requires 5 crores NRV), then you can get Prestige free of cost with renewal benefits too 🙂

Hello Shipra & Ajay

I recently upgraded to CitiBank Prestige Card and have recieved Priority Pass Card as well, i will like to know which priority pass membership plan of priority pass I am entitled, or i need to buy priority pass membership plan separately

Thank you everybody for sharing such useful information about Prestige Card

I have recently swapped my premiere miles card with Prestige Card

I wonder if i can apply for a new Premiere Miles card and use both Premiere Miles as well as Prestige Card

Will CitiBank allow me?

Abrar, how much was premier miles limit before swapping?

At what ratio, they swapped the existing reward points of premier miles?

My limit on Premiere Miles was more than 5 lacs, i got my premiere miles converted to Prestige Points @0.45 ie 100 Premiere Miles = 45 Prestige Points

What about 10000 bonus miles which Citi prestige talks about? Have you got them as well in the form of 2500 additional prestige points?

by any chance does this comes with lifetime free?

@Nithin, it does not come lifetime free and people have to pay to get benefits of this card. Paid cards are a good thing 😀

Hello all

Is it necessary to have a gross annual income of 40 lacs for this card ?

I have the Citi Premier Miles Card and having been using it since the past 5 years . No defaults on payments ever.

My gross annual income is 6 lpa

Do you think I could get this card ?

@Rahul if your premiermiles has an INR 5 lakh credit limit then you can get an automatic upgrade

Are you Sure? I have a Credit limit of 6+ lacs. But, they never initimated me about such chance. Should I directly call Citi Prestige Customer Care?

Citi Prestige India has temporary suspended transfer of miles to Air India – Flying returns program for operational reasons. With the current state of affairs with Jet, what would be a good strategy to redeem miles / points on the domestic sector?

Can you tell me about the Taj Epicure Plan benefits also, of it’s still there and also if it’s also renewed each year ?

My only concern with this card is the pathetic concierge service. They market themselves as a top end lifestyle card, but I cant seem to get anything done from the concierge.

Their responses are fast, but low on quality. They couldn’t suggest proper travel itenaries. Couldn’t find any runners in Bangalore. No runners available in Hyderabad etc.

For all the readers who are asking about the ‘self serve’ portal, It is none other than Hotels.com.

Citi provides you with a coupon code to be used for availing 4th night free, however I have found that the regular per night prices are higher on the website with a little monetary benefit from the the complimentary 4th night at the expense of your hotel loyalty points, if you have one. Though not the case always.

Nevertheless there is a self serve portal for availing airport transfer too.

Concierge service is hit or miss depending on the executive you get to talk too. On my recent trip to Phuket I asked hotel recommendation and prices for given dates, surprisingly the prices they quote were at least 50% cheaper than regular OTAs.

With a bit of suspicion I called next morning to book only to find that those prices were not available (all 10 hotels) and were now at par with any other OTAs, what surprised me was their blatant stubbornness that those prices were available 12 hours ago (when I received the quotation), clearly the agent who sent me the quotes did some mistake but they never accepted this and keep repeating that it is a dynamic pricing and they use a exclusive portal blah blah.

>>Nevertheless there is a self serve portal for availing airport transfer too.<<

What is the url for this, if you don't mind?

If you have booked airport transfers with them in the past then you will find the link in the confirmation email.

If you tried to search for something like “citi 4th night free india” this shows up as one of the top 5 results in google! It’s part of the “visa-promotions” suite of webpages.

I meant search for “citi airport transfer india”!

Hi Ajay,

The self service portal for booking 4th night free is news to me. I called up the concierge and she told me no such service exists. That you have to call them up to do the bookings.

Can you please elaborate on this as to how do you get this lin

Insightful, thanks for sharing this post on the Prestige Card. How would you compare this against HDFC Infinia?

@Deepak, Infinia is a different ball game. only 3-4 partners and no ability to use the points at 14 different partners. This is an all rounder.

What perfect timing of this article. I just got my prestige card and have trips planned for Singapore and Korea this year. So now I know how to milk the card for all its worth ;).

Thanks for a wonderful article.

One query. I am unable to find the self book option. Can you please elaborate on it?

Thanks

@Dr. Ninad, call the concierge, they will let you know 🙂

thanx

This is one of those cards where I am unsure if I would ever go for it if eligible..

I mean, I love the Priority pass for main (and I think supp card member also)..

Can see value of meet and greet though not super important.

But every other value, and value chart of 4 miles/100 isn’t that great to be honest..

Neither is renewal benefit as impactful..

At same time, I think it has some great miles partners where if I better understand the miles game, can get 4% effective reward rate.

Not sure what u are talking about. This card has the highest reward rate @4%. For the 20k fee. U get 10k taj vouchers + 10k miles. Anybody with a little sense should be able to atleast get a value of 70p for every mile. So 17k INR is already covered. Lets add 3k for the airport transfer (cost of Uber in bangalore)- u have ur 20k taken care off.

Can PP be used for lounge access at GVK? I was not aware of that!

@HTC PP can be used for lounge access only by JP Platinums whose lounge access was taken away.

Great insight into the card benefits. Definitely a fantastic card if we would get a chance to use all the benefits

The only thing that I don’t like about the card is the fact that it’s “Invitation Only” ~apparently~!!!

It’s not. But you need to already have a CC with Citi, AFAIK. Preferably PremierMiles. I just had to ask to get it.

Show income proof of Rs 40 lakhs and the card is yours!!

Much needed information

About International Insurance do they issue policy each time we request for VISA PROCESS or its year long policy valid only for 30days international trip

Thank You Shipra & Ajay

Year long

Year long, with 90 day policy documents. No geographical restrictions, no trip length restrictions. The most forgotten benefit of this card, saves 15-18K every year.

so how do i get the insurance policy? do i need to book the tickets with the prestige? need to submit the policy for a visa

@Jude, call up the Prestige banking line and request for it. I usually ask them to email me a copy followed by hardcopy of the policy.

Yes but it is only for the primary card holder, am I correct ?

I believe It is not applicable for Schengen Visa since Citi insurance only covers medical expenses, and NOT medical evacuation and repatriation of remains. You can double check with the customer care. This is a rather sore point if you ask me, as I will still need to buy my own insurance thanks to the limited coverage.

Shipra, if I convert the Citi points to JP miles during the bonus offers like – https://www.jetprivilege.com/offers-deals/convert-reward-points-to-jpmiles – can I essentially score 6 JP miles per 100 Rs spent?

@AJ the offer is over now, so no longer applicable

Yes, but was the offer applicable for Citi? Because even your post about it didn’t include Citi has one of the participating banks for that offer. Back in December, JP had 50% conversion bonus too. If that is not the case, then this card becomes questionable for Jet elites given 5.33 miles/100 from HDFC Jet Diners/Amex Jet Plat.

@AJ various banks offer various benefits at all points of time. I don’t endorse earning only one kind of miles in your lifetime. So, I earn JPMiles with other ways and not through my Citi Prestige Credit Card. I also hold the Jet Amex and the Jet ICICI Amex and the Jet IndusInd cards for the record.

Hi Shipra. I must have been living under a rock , as I had no idea about this “self-serve” booking portal for the 4th night benefit. How does one go about this ?

Yes please would love to know about this as well

This is what Citi has told me when I asked about a portal for the same

To your query, we would like to apprise you that to avail 4th Night benefit offer the booking will have to be made through concierge only as special offer code is applicable to process the booking under this benefit.

You people are real inspiration for me other Indians too and yes article is highly informative

I seriously feel it’s not worth paying 20000 plus taxes..most of the benefits mentioned are like which are used forcefully just because it is there..

Like lounge access many other cards give,taj vouchers too, airport pick up,at much lesser fees..

Just my take, anyways thanks for the article

Let’s walk the Talk

Please share info let’s

do evaluation

Unlimited International pass for all you addon card holders is a rare feature.

+ Meet and greet at Bombay/Delhi airport is a huge time saver. Who else is offering that at a lesser price?

This…

Unlimited pp for 1+4 I think is huge .

Add the vouchers and airmiles and meet and greet and it’s a Kickass card to have, though not the go to card I feel for major purchases.

If I ever do get the offer, would evaluate it as a membership of PP.

Not to mention one of the few PPs out there which allow usage within India. The arrival lunch and dinner at Aviserv Mumbai alone is a major benefit for me. And the lounge is not on any card network.

Could you tell me more about this ? Where abouts from T2 Can I access this ? – Thanks in advance 🙂

T2 arrivals. Right before the exit, look for black signage that points to “lounge”. It took me a while to find it the first time. Ask airport staff to help you. It’s called Aviserv.

The food there is amazing.

Unfortunately most domestic arrivals happen at T1 of Mumbai. So I think you can avail this arrivals lounge only if flying in from overseas.

The meet and greet service/benefit – can one avail it even if the air ticket hasn’t been booked through the prestige card?

@Amit not mandatory to book ticket. The meet and assist service needs to be requested via the concierge minimum 72 hours prior.

Ok, cool. Thanks Shipra!