Like we wrote earlier today, HDFC Bank and IndiGo are partnering on launching a new co-branded credit card. They have just announced the latest credit cards at an event being held at DLF Promenade in Delhi and will be riding on the MasterCard platform for this one.

The new credit cards, in the legacy ways of IndiGo, have been branded as ‘Ka-ching’, going after the sound of the money till reference. The cards will be launched in two variants, 6E Rewards and 6E Rewards XL. Customers will be able to avail of complimentary Air Tickets on activation for an amount of INR 1500 or INR 3000, depending on the variant. The credit cards will allow customers to accrue accelerated 6E Rewards on IndiGo transactions. They can also earn additional 10-15% 6E Rewards on dining, shopping, transport and medical spends with Featured Partners.

Furthermore, customers will have access to other benefits, including priority check-in, choice of seats, and a complimentary meal.

The Ka-ching card will also offer 14 travel and lifestyle benefits. This includes lounge access, complimentary expert medical opinions from global experts, freedom to play golf in some of the top golf courses in India. Cardholders will also be able to avail

Mastercard concierge services, airport limousine service and enjoy premium benefits and savings on hotels, car rentals and flight bookings.

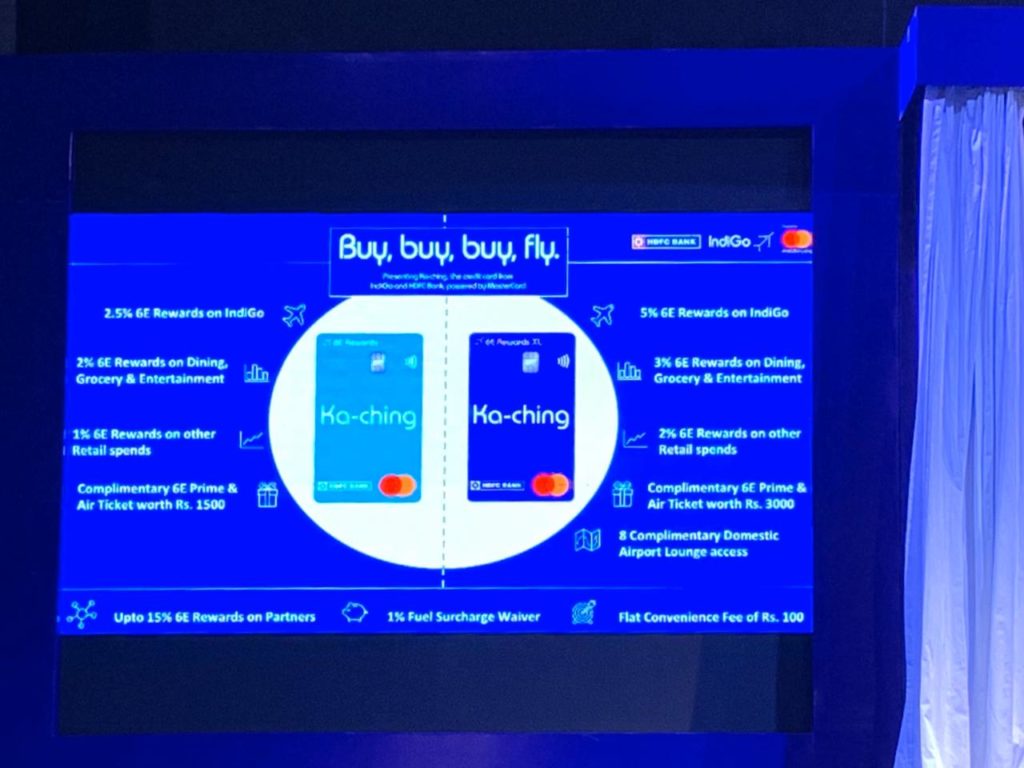

Let’s have a look at the two variants. The 6E Rewards card, which will be the entry-level card, will have the following features.

- Complimentary Air Ticket worth INR 1,500 on activation

- 6E Prime Add-on (priority check-in, choice of seat, and a complimentary meal)

- 2.5% 6E Rewards on IndiGo transactions

- 2% 6E Rewards on dining, entertainment and grocery transactions

- 1% 6E Rewards on all other non-IndiGo purchases (except fuel & wallet)

- Up to 10% 6E Rewards on Feature Partner transactions

- A discounted convenience fee of INR 100 per passenger per segment

- 1% Fuel surcharge waiver

The 6E Rewards XL card, which is the higher-end version of the product, is even more power-packed and has a much higher reward on spends:

- Complimentary Air Ticket worth INR 3000 on activation

- 6E Prime (priority check-in, choice of seat, and a complimentary meal)

- 5% 6E Rewards on IndiGo transactions

- 3% 6E Rewards on dining, entertainment and grocery transactions

- 2% 6E Rewards on all other non-IndiGo purchases (except fuel & wallet)

- Up to 15% 6E Rewards on Feature Partner transactions

- 8 Complimentary Domestic airport lounge access

- 1% Fuel surcharge waiver

- A discounted convenience fee of INR 100 per pax per segment

The 6E Rewards card will be priced at INR 750 per annum, and the 6E Rewards XL will price at INR 2,500 per annum. These are products which are targetted at the sophisticated Indian travellers, who are counting on IndiGo for their travel needs. The product will be a by-invitation product for the moment, and IndiGo will choose the customers to invite at the moment. I appreciate that strategy since it worked very well for the Amazon ICICI Bank launch, and it also allows for the Bank/Airline to iron out the issues before they open up the product for everyone. For everyone who signs up for the product, they are getting their money back just with the air tickets itself.

In the process, IndiGo has also walked into another transition phase of their journey. 6E Rewards will most probably be a loyalty programme of some sort as well, but will it be only available for customers who have the cards or not. I am told by Shipra, who is at the event, that redemption is not a straight-through 1:1 redemption, in the sense that 1 point = 1 INR is not a done deal.

Bottomline

IndiGo has finally taken the stepping stone of transitioning from a no-frills airline to a more evolved network carrier, such as JetBlue in the USA. HDFC Bank is a great partner to go with, given the number of regions HDFC Bank will be able to cover for IndiGo. For instance, customers of this card can sign up from Gorakhpur as well as Guwahati, and not just the metros which would be the case with, let’s say, a Citibank.

What do you think of the new IndiGo Credit Card powered by HDFC Bank and MasterCard?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. Even though the amount you enter has to be in INR, you may use an international card to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Please update the post that it is a 1 Time use prime voucher. Your post does not mention that which is very misleading.

two of the worst customer service orgs together. cannot be more awesome.

HDFC Bank should bring some of these 6E benefits on HDFC Diners black. So we do not have to carry additional cards

You cannot carry additional cards. For a while now, HDFC only issues one card per customer ID.

Not true, I have two credit cards (taken last year) against my single customer ID.

Detail T&C are up on the indigo website:

Major one’s are:

– Complimentary IndiGo air ticket will be available for redemption towards base fare post doing three (3) transactions every month for first three (3) calendar months. (WTF!)

– Insurance spend is allowed upto Rs 125K in a billing cycle (for XL) and Rs 250k for regular

– 6E Rewards redemption fee is INR 100 per pax per flight booking

– No restriction or blackout dates on redemptions. 1 6E Rewards = 1 INR.

–

1 Reward = 1 Re with no blackout date

Any idea if HDFC allows multiple credit cards for a customer? Already hold a Diners Black.

I hold a regalia and JP MC Platinum with same amount as limit but they arent shared limits

After 9W being grounded. 6E is the only airline which provides reasonable domestic connectivity from my base IXE. Hence makes sense to apply if invited and the features seem promising

Features looks cool!

My only doubt:

Will we get 6E prime ONLY if we book through Indigo portal using this card or on using this card on booking tickets in HDFC smartbuy portal

Or using this card on booking Indigo tickets on Any OTA too?

– from a persorn who took 100 6E trips in 2019!

There may be an impression that these cards would allow unlimited used of 6E Prime benefits. Unfortunately, that’s not true. Every card member gets (only) one 6E Prime voucher as welcome benefit!

Once only 6E prime voucher! Not expecting that! Was expecting a unlimited usage of 6E prime!

At lest they can give 6E prime vouchers on spend based like spend ₹50,000 and get 3 6E prime vouchers like that.

Finally a indigo co branded card. The 6E prime itself is a major benefit for people who travel often on indigo.

Looking forward to getting this one.